Carried interest, flat tax and fair tax.

The Republican candidates for president have been throwing around a lot of unfamiliar terms as they roll out their plans to reform the nation's tax system. And they'll likely talk more about these proposals at Wednesday's debates on CNN.

Most of them involve lowering taxes. That is the key to boosting economic growth in the Republican playbook, after all.

CNNMoney explains what all the jargon means.

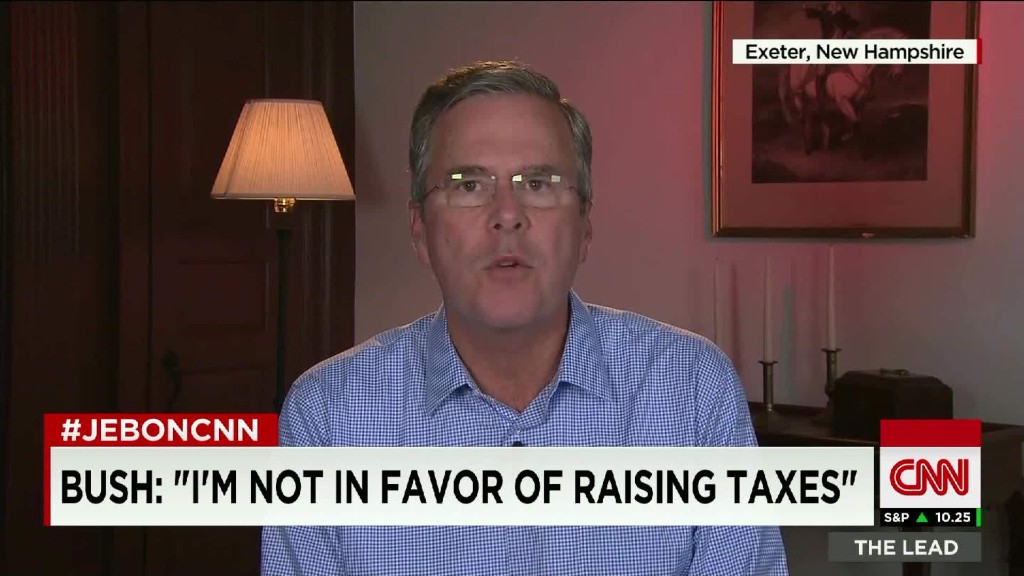

Carried interest: Hedge fund managers are the latest target for some GOP candidates. Real estate mogul Donald Trump and Jeb Bush, the former Florida governor, want to crack down on an IRS loophole that allows hedge fund honchos to list their profits as "carried interest" instead of income. So these earnings are taxed as capital gains, which carry a top rate of 20%, plus a 3.8% surtax, instead of as wages, which currently have a top tax rate of 39.6%, plus a 2.9% Medicare tax.

"We're going to be reducing taxes for the middle class, but for the hedge fund guys, they're going to be paying up," Trump said on CBS' Face the Nation Sunday. "...they pay very little tax, and that's going to end."

The candidates are not the first to suggest raising taxes on hedge fund managers. On several occasions, President Obama has proposed taxing carried interest at ordinary income rates, a plan the Treasury Department estimated would bring in $18 billion over 10 years. So far, these proposals have gone nowhere.

Flat tax: Kentucky Senator Rand Paul, neurosurgeon Ben Carson and Texas Senator Ted Cruz all favor a flat tax. They would jettison the tiered rates of the current system and replace them with a single rate on income.

Paul says he would institute a 14.5% rate on all personal income, including wages, capital gains, dividends and interest. He'd get rid of the payroll tax. He'd also levy a 14.5% tax on business revenues, compared to the current top corporate tax rate of 35%. But he would also eliminate businesses' current ability to deduct wages. That would likely lead to employers reducing salaries and raises, said Joseph Rosenberg, senior research associate at Urban-Brookings Tax Policy Center, a non-partisan research group.

Carson, on the other hand, says his flat tax rate would be between 10% and 15%. He likens it to tithing, or donating 10% of your income to the church.

Cruz hasn't offered details on his plan yet, but has said it would be so easy that Americans can file their returns on a postcard. He also wants to eliminate the Internal Revenue Service.

The main problem with the flat tax system is that the rate would have to be at least 25% to bring in as much revenue as today's system, said Rosenberg. But Paul has said he doesn't see that as a problem since he wants to greatly reduce the size of the federal budget anyway.

Another criticism of the flat tax is that it's generally seen as a giveaway to the wealthiest Americans.

"You are reducing taxes by far the most at the very high end," said Rosenberg.

Fair tax: Mike Huckabee, the former Arkansas governor, is pushing the Fair Tax, which he says will solve many of the nation's fiscal issues, including the shaky finances of Social Security and Medicare.

The proposal calls for replacing income and capital gains taxes, as well as payroll taxes, with a national sales tax. The rate would be 23%, but it means that out of a $1 purchase, 23 cents would be in taxes. Most would consider it a 30% sales tax: 23 cents on top of the original 77-cent purchase.

"The Fair Tax transforms the process by which we fund Social Security and Medicare because the money paid in consumption is paid by everybody, including illegals, prostitutes, pimps, drug dealers, all the people that are freeloading off the system now," he said at the August GOP candidates' debate.

The idea is that tax evaders and those involved in the sex trade and other illegal activities don't pay taxes on the income they earn. But under a Fair Tax, they'd have to pay taxes on the items they buy, just like everyone else.

But many experts -- on both sides of the political aisle -- say the Fair Tax wouldn't bring in the same amount of revenue as the current tax system.

"The rate is just not enough to replace all the revenue they want to eliminate," said Alan Viard, resident scholar at the American Enterprise Institute, a conservative think tank.