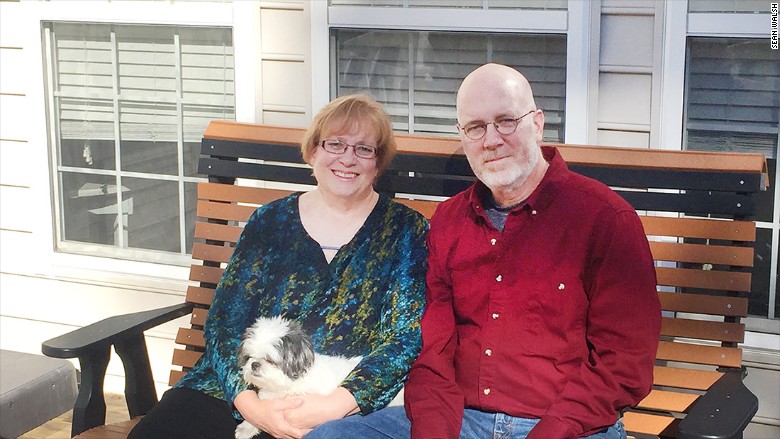

For the past 20 years Susanne Walsh has been dreaming of a retirement where she'd travel the world.

Unfortunately, those retirement plans are now on hold -- indefinitely.

That's because Susanne and her husband Bill helped pay for their two sons' college education and even cosigned on some of their student loans. Despite graduating with four-year degrees, neither of them have found stable jobs.

Now Bill and Susanne are shouldering the brunt of roughly $189,000 in combined student loans.

"I really didn't think I'd still be working at this age," Susanne, 59, told CNNMoney.

Related: How one grad cut her student loan debt by $20,000

Waiting tables despite degree

The couple is currently paying $744 a month on their 24-year-old son Tim's roughly $129,000 of student loans.

Tim graduated from Rutgers University with a bachelor's degree in journalism and media studies. He's especially interested in a Hollywood career, but has found it hard to land a job there, though he's picked up some spots as an extra on TV shows. Tim is mostly trying to make ends meet by working as a waiter and bartender.

"He's a struggling young artist out there. He has next-to-no income," said Bill, who is 57 years old and cosigned his son's loans.

Parents who cosign on a child's student debt assume equal responsibility for repaying the loan. That means late payments can hurt the parent's credit rating, not just the child's.

Their other son, Sean, lives at home and is pursuing a second degree. He has about $60,000 in student debt from earning a bachelor's degree in technology management from the Pennsylvania College of Technology in Williamsport.

The 28-year-old's student loans are in deferment, which means he can temporarily postpone the payments. However, the loan continues to accumulate interest.

Sean is now pursuing another bachelor's degree, this time in computer science, from the University of Mary Washington in Fredericksburg. He is paying for this degree as he goes, with help from an internship program with the U.S. Navy.

Couple lost jobs during recession

For the parents, it's been a tough few years. Both of them lost their jobs during the Great Recession and moved to Virginia from New Jersey in 2009.

Bill currently works as chief of operations at the Naval Surface Warfare Center in Dahlgren, Va., a facility that developed the weapon control system for Tomahawk missiles. Susanne works at the same naval base, doing writing and editing work for a local contractor.

To help support their sons, the couple also has a side business providing editing support for a technical engineering journal.

"I never expected it was going to turn into this much of a fiasco," Susanne said.

Many parents are in the same boat

Their frustrations are reverberating in thousands of families in today's world of explosive student debt growth.

Ninety-four percent of parents of college students are increasingly feeling the burden of student loan debt, according to a 2014 survey by Citizens Financial Group. More than half of those parents worry that the cost of college will impact their ability to retire when they had planned to.

It's a common problem that financial planners see.

"The sooner you decide how you're going to tackle college expenses ... the clearer your savings goal will be and the easier it will be to plan how to reach it," said Kevin Sporer, an Ameriprise advisor the Walsh family hired once they were faced with the daunting student loan payments.

Sporer couldn't comment on his specific advise for the Walsh family. However, he said in situations like this he typically looks for ways to improve clients' cash flow by reducing monthly expenses like cable bills, refinancing mortgages to lower rates and shopping around for insurance coverage.

Sporer also researches ways to refinance student debt, though he said the options are often limited.

Related: Debt collectors now can robocall to collect student loans

Middle class hit the hardest

The struggles facing Bill and Susanne show how in many ways the middle class has been hit the hardest by the student debt trouble.

A big chunk of Tim's debt, for instance, is held by private lenders because he maxed out on federal loans and couldn't qualify for need-based aid since his parents made "too much" money. The fact that their income qualified as "too much" makes them wince.

"We don't qualify for the grants or the tax deductions because we make too much money. But we sure as hell qualify for the student loans," Susanne said.