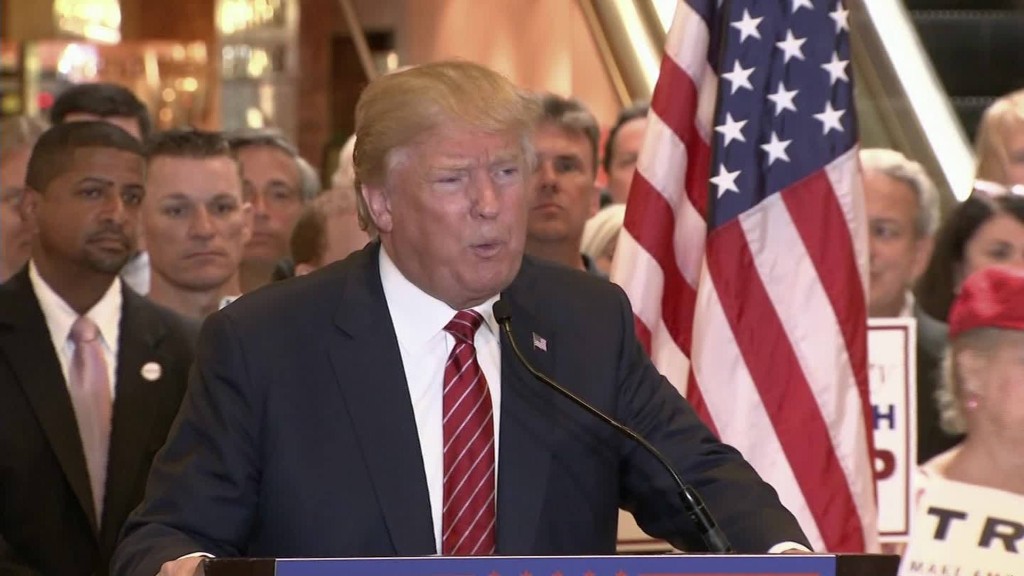

When Donald Trump put out his four-page tax plan in September, he said it wouldn't increase deficits.

The economic growth it would spur, along with his spending cuts, would compensate for any potential loss in revenue from tax cuts, he said.

Under his tax plan, Trump said he'd have to pay more than he does today.

But an analysis by the Tax Policy Center released Tuesday suggests neither of those assertions are particularly grounded in reality, given what he's proposed so far.

Key provisions in Trump's tax plan

Fewer and lower rates: Trump would reduce the current seven income tax rates to just three: 10%, 20% and 25%. That's well below today's top rates of 28%, 33%, 35% and 39.6%.

Much bigger standard deduction: Trump would also increase the standard deduction to $25,000 for single filers and $50,000 for married couples. That's about four times higher than the current one.

Limit value of itemized deductions: Most filers would choose the extra-large standard deduction under Trump's plan. But those who still choose to itemize would be limited in how much of a deduction they could claim. The only deductions not subject to the limitation would be the mortgage interest deduction and charitable contributions.

Same investment tax rates: Trump would continue to offer today's preferential income-based tax rates rates of 0, 15%, and 20% on long-term capital gains and qualified dividends.

Several taxes eliminated: Trump would repeal the estate tax, the alternative minimum tax, and the 3.8% surtax on investment income created under Obamacare.

Tax cuts for all, but a boon for the rich

The Tax Policy Center analysis estimates that Trump's tax plan would cut taxes for everyone.

But the biggest tax benefit by far would go to the very wealthiest households.

Middle-income households would see their taxes cut by an average of $2,700, or 4.9% of after-tax income. Those in the top 0.1%, however, would see their taxes reduced by an average of $1.3 million, or 19% of their after-tax-income.

And contrary to Trump's assertions that he would crack down on investment fund managers who benefit from a very low tax rate on some of their income today, the Tax Policy Center found those managers could see a windfall under Trump's plan.

Trump's campaign never responded to the Tax Policy Center's questions about his proposals. But the think tank said when it had to fill in the blanks by making assumptions about Trump's intentions, it chose those that would minimize the benefits to high-income households as well as the plan's potential revenue loss. In other words, it gave Trump's plan the benefit of the doubt.

A serious deficit buster

The analysis estimates that Trump's tax plan would increase deficits by at least $9.5 trillion over a decade and by another $15 trillion in the second decade.

Those figures don't include the interest costs that would be incurred if the government borrowed money to make up the difference. Interest could add several more trillion dollars to the debt.

And all that additional debt could negate the positive economic effects of lowering rates, such as boosting incentives to work, save and invest.

To support those potentially good effects, the revenue loss from Trump's tax plan would have to be counteracted by spending cuts. Really, really big, unprecedented spending cuts.

Just in 2025 alone, the Tax Policy Center estimates that federal spending would need to be cut by at least 20%. That would amount to more than 100% of defense spending, or 82% of domestic program spending, or 41% of Medicare and Social Security spending.

But here's another thing: Trump on several occasions has said he wouldn't touch Medicare and Social Security.

So that would mean he'd need to cut vast amounts of defense and domestic spending combined, which would likely be intolerable politically and practically.

When asked to respond to the Tax Policy Center analysis, a Trump campaign spokesperson said, "The policy speaks for itself and many experts, including Larry Kudlow, have praised the plan since its release in September."

Related: The problem when Donald Trump rails against the debt

Related: Jeb Bush would cut taxes for everyone, but ...

-- CNN's Jeremy Diamond contributed to this report.