Planning for retirement is tough. Figuring out how much money you'll need for health care is even tougher.

More than half of people over 50 recently surveyed by Nationwide said they were "terrified" of the uncertainty.

Health care will likely be your biggest expense during the golden years. It's obviously a tough number to nail down and one that will vary by person, but there are estimates out there. A 65-year-old, healthy couple can expect to spend $266,600 over the course of their retirement on Medicare premiums alone, according to HealthView Services. An estimate from Fidelity is a little less: $245,000. Neither include out-of-pocket expenses or long-term care costs.

No matter how you break it down, health care costs in retirement are expected to keep going up. Fidelity's tally rose 11% in the past year.

Calculator: Will you have enough to retire?

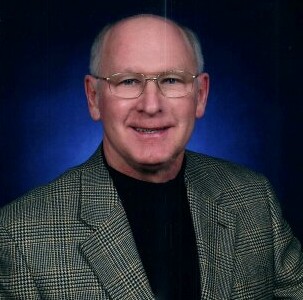

"At our age, health care is at the top of our list of concerns -- especially when you think about the fact that we're on a fixed income," said Gene Ratchford, 70, who lives with his wife Sandra, also 70, in North Carolina.

Health care takes up the biggest chunk of their budget after the mortgage payment. It cost them nearly $12,000 during 2015, according to his meticulously kept spreadsheet. That includes everything from premiums and co-pays, to prescription drugs -- and the gas used driving to doctors' offices.

The previous year, the Ratchfords spent $17,500. Why so much more? New hearing aids cost them about $6,000 and the premium for their supplemental Medicare plan jumped by about $19 a month.

"The uncertainty creates a lot of anxiety for people. If you're freaking out, you're not alone," said John Carter, the president of Nationwide's retirement plans business.

You don't have to feel completely in the dark, though. Here are some things to keep in mind.

Medicare premiums are the biggest budget buster

Most people don't pay a premium for Medicare Part A, which covers hospital visits. But you will pay monthly premiums for Part B (doctor services and outpatient care), Part D (prescription drugs), and supplemental coverage which may pick up the cost for deductibles, co-pays and medications. These could be taken straight out of your Social Security check.

The premium for Part B is tied to inflation. Most people paid $105 a month in 2015 -- and it isn't going up at all in 2016. You might have to pay more if you don't get Social Security because you receive a government pension, or if your annual income is more than $85,000.

The premiums for Part D and supplemental insurance are set by your provider and vary by plan and by where you live. You can expect these to take up a big chunk of your expenses and are big drivers of rising health care costs.

Part D premiums were expected to go up an average of 12% last year, according to HealthView.

Medicare doesn't cover everything

You'll still have to pay for some expenses out of pocket. And Medicare doesn't cover things like long-term care, or dental and vision insurance.

How much extra you'll need really comes down to how healthy you are, how long you live and at what age you retire. Use a calculator like this one from HealthView or this one from AARP to get an estimate that takes your personal information into account.

Plan to spend more each year (sorry!)

Your health care will likely be cheapest during your first year of retirement. There are two reasons for this. You need more health care as you get older, and costs are expected to keep climbing. The average monthly health care expense for a couple at 65 is $583, according to HealthView. But expect to spend more than double that amount each month by the age of 85.

Women will need more than men

Because women live longer, a 65-year-old woman can expect to spend $22,000 more in total health care costs over the course of her retirement than a man her same age.

Remember to save money in your HSA

Any worker who has a high-deductible health care plan can get a Health Savings Account. It's a great place to save money for future health care costs because contributions aren't taxed when they go in, or when they come out -- as long as the funds are used for health care expenses. Some employers who offer HSAs also contribute money, usually on an annual basis. You can contribute up to $3,350 a year -- and the funds can be invested in stocks and bonds just like a 401(k).