It's all looking gloomy on Wednesday.

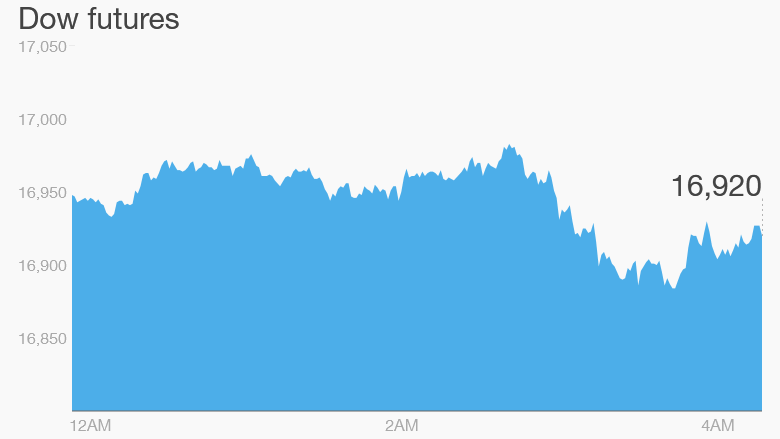

U.S. stock futures are dropping by more than 1.5%, and markets in Europe and Asia are mostly lower. Oil is falling again.

Here are the six things you need to know before the opening bell rings in New York:

1. Scary geopolitics: As the diplomatic standoff between Saudi Arabia and Iran continues, there's more worrying news from Asia. North Korea said it carried out a hydrogen bomb test, which if confirmed would be a first for the reclusive regime and a significant advancement for its military ambitions.

The sense of risk is weighing on global stocks, but it's also giving a lift to gold, a traditional safe haven asset.

2. More weak data from China: The country's services sector grew at its weakest pace for 17 months in December. China stocks dropped after the open, but steadied to close more than 2% higher on reports that the government was taking more steps to support the markets.

Related: Investors should focus on China's economy, not stocks

3. Stock market movers -- Apple, Pioneer Natural Resources: Shares in Apple (AAPL) are dropping by more than 2.5% premarket after falling 2.5% Tuesday on reports that it is cutting iPhone production due to weak orders.

Oil and gas producer Pioneer Natural Resources (PXD) is down about 7% premarket after announcing it would issue 12 million new shares to fund expansion.

Related: Why Apple's stock fell in 2015: iPhone worries

4. Economics and earnings: At 2 pm, the Federal Reserve will post the minutes from its Dec. 16 meeting, where officials decided to raise U.S. interest rates for the first time in nearly a decade. The minutes may provide new clues about what the Fed has in store for rates in 2016.

At 8:30 am ET, investors will be watching for U.S. export and import data from November. At 10:30 am, the U.S. is due for a weekly crude inventories report.

Agricultural products giant Monsanto (MON) is due for an earnings update before the opening bell rings on Wall Street.

5. Markets overview: European markets are all down by more than 1% in morning trading. Asian markets ended the session slightly lower, except for markets in China, where the Shanghai Composite ended up 2.25%. Korea's Kospi edged down 0.3% and Japan's Nikkei dropped 1%.

U.S. oil futures are dropping around 2.5% to $35 per barrel. Brent crude, the global benchmark, fell by more than 3% to a new 11-year low.

The Dow Jones industrial average inched up 0.1% on Tuesday, while the S&P 500 and the Nasdaq each added 0.2%.