Investors in China flipped out today and sent stocks tumbling. But traders in the rest of the world are staying cool.

Here are the five things you need to know before the opening bell rings in New York:

1. Chinese index down over 6%: The benchmark Shanghai Composite index plummeted 6.4% on Thursday, snuffing out a recent recovery rally in brutal fashion. Now losses for this year are close to 23%.

2016 has been rocky for Chinese markets. The government just sacked the head of its stock market regulator, the yuan has struggled against the dollar, and investors have been pulling billions of dollars out of the country.

Sharp falls in Chinese stock markets in early January helped fuel a wave of selling around the globe. There's little direct correlation between China's markets and its economy but concerns remain about how fast growth is slowing.

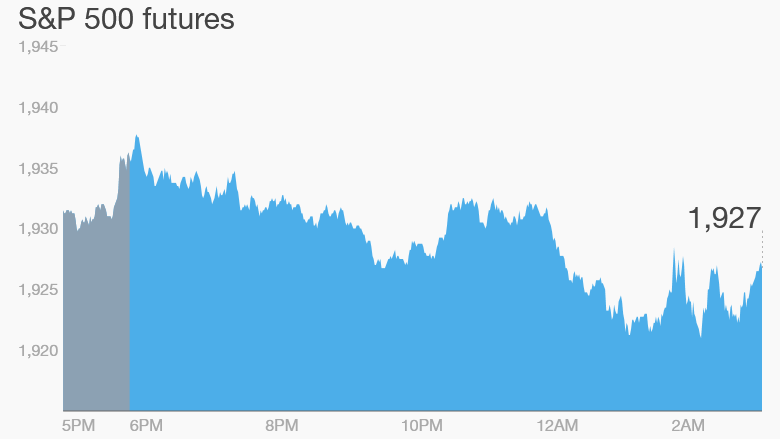

2. Just stay calm: U.S. stock futures are looking soft on Thursday but investors aren't panicking after China's falls.

Oil prices are dipping by about 1.5% to trade around $31.50 per barrel.

European stock markets are posting healthy gains in early trading, with many indexes jumping by more than 1%.

Shares in Lloyds Banking Group (LYG) in London are surging by about 10% after the bank announced it was hiking its dividend. Lloyds is leading the benchmark FTSE 100 index higher.

Asian markets outside China ended the day with mixed results.

3. Foxconn reconsiders Sharp takeover: A planned takeover between two important Apple suppliers is at risk of falling apart.

Struggling Japanese electronics firm Sharp (SHCAY) said Thursday it agreed to be bought by Taiwan's Foxconn. But then Foxconn said it would postpone signing a definitive agreement while it reviewed "new material information".

The bizarre series of events raises questions about why Sharp went ahead and announced the deal if it knew Foxconn was getting cold feet.

4. Earnings and economics: Investors will be parsing through quarterly results from a range of companies this morning, including Anheuser-Busch InBev (AHBIF), British American Tobacco (BTI), Best Buy (BBY), Campbell Soup (CPB), Gogo (GOGO), Kohl's (KSS) and SeaWorld Entertainment (SEAS).

After the closing bell, we'll hear from Kraft Heinz (KHC), Gap (GPS), Baidu (BIDU) and Weight Watchers (WTW).

5. Weekly market recap: This week has been quite rocky.

The Dow Jones industrial average, S&P 500 and Nasdaq shot up Monday, dropped Tuesday and then posted a modest recovery on Wednesday.

The latest reading on the CNNMoney Fear and Greed index shows market sentiment is neutral right now. Go figure.