America's biggest companies are holding about $1.4 trillion in cash offshore to avoid paying billions in U.S. taxes, according to a new report by Oxfam America.

Companies are supposed to pay federal taxes on their global profits, but the tax on money made overseas is only due when it's brought back to the U.S.

This policy has encouraged some firms -- including Apple (AAPL), Microsoft (MSFT) and Google (GOOGL) -- to hold huge amounts of cash overseas.

Even though large companies have faced public outrage for stashing cash outside their home country, the practice is legitimate and the companies say it would be detrimental to repatriate the money.

The U.S. government levies a 35% tax rate on repatriated cash. That's a much higher rate than many companies currently pay, according to Oxfam. It said Apple's effective corporate tax rate was 25.9% between 2008 and 2014.

Related: The country with the highest income tax in the developed world

The new Oxfam report shows that Apple holds the most money offshore of any major U.S. company, at $181 billion.

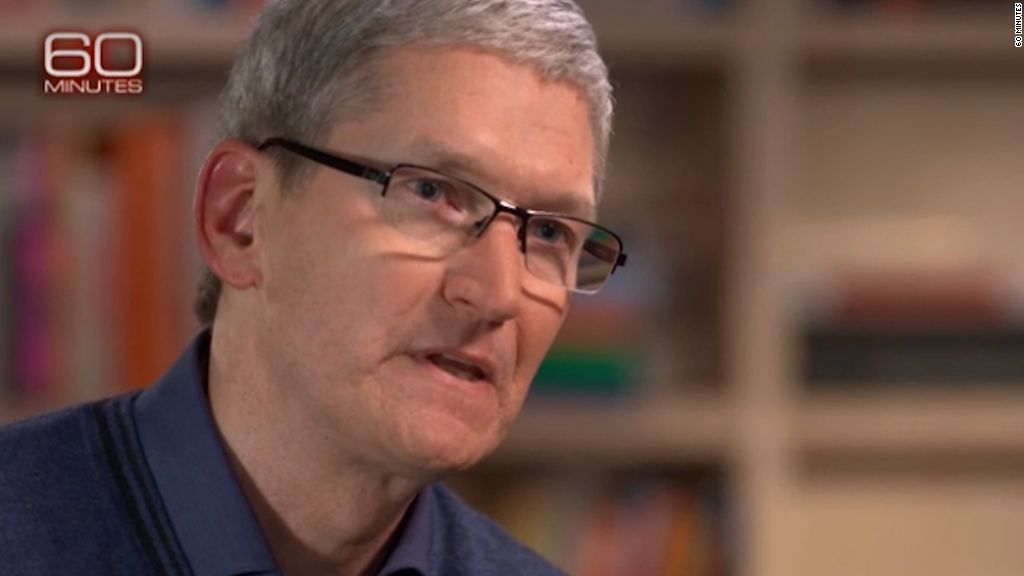

Apple CEO Tim Cook said in December that he would "love to" repatriate Apple's foreign profits but that he can't because "it would cost me 40%."

The 40% refers to the combined U.S. federal and state tax rate Apple would likely owe.

Related: Europe plans to force big firms to come clean on profits and tax

General Electric (GE) holds the second largest offshore cash stash, at $119 billion. Microsoft (MSFT), Pfizer (PFE) and IBM (IBM) round out the top five U.S. companies with the most offshore cash.

This issue has long flummoxed policymakers in Washington, some of whom are inclined to offer the companies a one-time tax break to entice them to bring the money home. But tax reform in the U.S. is slow at best, and the chance that lawmakers will tackle this issue in an election year is very slim.

Oxfam based its $1.4 trillion calculation on 2014 financial reports from 50 of the biggest companies in the U.S.

Oxfam said some of the cash may be re-invested in foreign subsidiaries, but still represents profits that escape U.S. taxation.