Friday generally arrives with a feeling of relief in offices across the Western world.

But that's simply not enough to get traders excited right now.

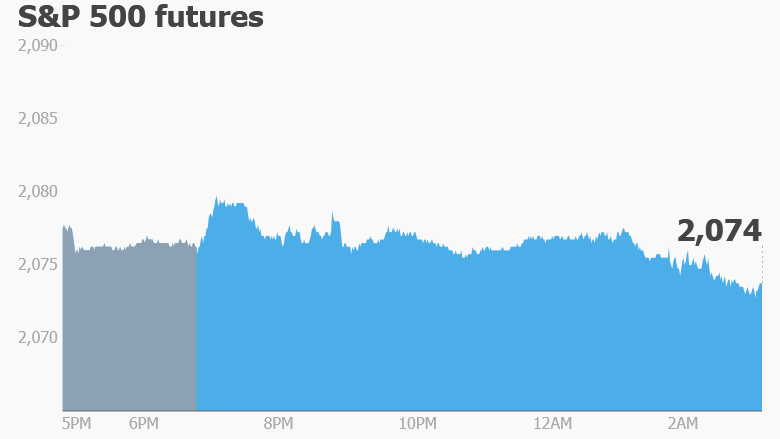

U.S. stock futures are looking soft and European markets are slipping in early trading.

Here are the five things you need to know before the opening bell rings in New York:

1. Chinese GDP: New data shows China's economy grew at its slowest pace in seven years during the first quarter.

Gross domestic product expanded by 6.7% in the three months ended March, compared with the same period a year earlier, according to China's National Bureau of Statistics. That's a tick above the 6.6% growth economists expected, according to the median estimate of a CNNMoney survey.

While this represents China's weakest quarter since the dark days of the financial crisis in early 2009, it is still "a milder deceleration than many had feared until recently," said Louis Kuijs of Oxford Economics.

Chinese stock markets slipped a tad on Friday, but the moves weren't dramatic.

2. Eyes on oil: Major oil producers are due to meet in Qatar on Sunday to discuss possible production freezes in an effort to boost global prices.

Traders will be watching the meeting closely. Oil prices rallied above $42 per barrel earlier this week on reports that Saudi Arabia and Russia reached a deal to cap oil output ahead of the meeting.

Crude oil futures are now trading around $41. There's considerable doubt about whether a broad production freeze including OPEC and non-OPEC countries can be agreed, and how effective it would be in tackling a supply glut.

3. Brexit campaign officially begins: Campaigning officially begins in the U.K. ahead of the June 23 referendum when British voters will decide whether the nation should leave the European Union.

Uncertainty about the outcome of the referendum has pushed the U.K. pound down versus all major currencies. Over the past six months, the British pound has dropped by 8.5% versus the U.S. dollar and 7.5% versus the euro.

The FTSE 100 index in London is dipping in morning trading alongside other European indexes.

Related: The truth about U.K. immigration

4. Earnings and economics: Citigroup (C) will post earnings before the opening bell rings.

The Federal Reserve will issue a March report on industrial production and capacity utilization at 9:15 a.m. ET. Industrial production was down 1% in February from a year earlier.

The University of Michigan Consumer Sentiment Survey for April comes out at 10 a.m.

5. Thursday market recap: Thursday was a pretty quiet day in the stock markets.

The Dow Jones industrial average was up 0.1%. The S&P 500 and the Nasdaq ended the day unchanged.