You'll need to keep your wits about you today. There's tons going on.

Here are the six things you need to know before the opening bell rings in New York:

1. Oil tumbles: Oil prices are dropping after the world's top producers failed to reach a deal on freezing output.

U.S. crude futures tumbled as much as 6.8% early Monday after a meeting of key oil nations on Sunday ended without an agreement. They steadied later to trade down 3% at $39 a barrel.

Prices had risen from $26 per barrel in February to above $40 on expectations a deal would be reached.

Meanwhile, Kuwait's oil production has reportedly slowed significantly following a strike by oil workers. The nation has the lowest production costs for oil in the world, at around $8.50 per barrel.

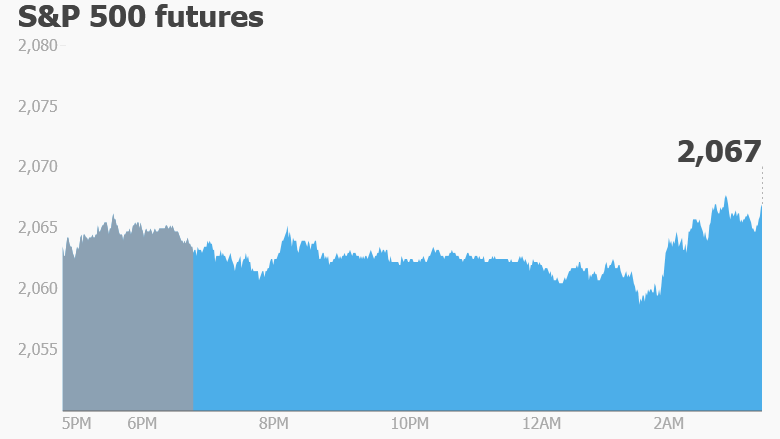

2. Global stock market overview: U.S. stock futures are dropping and nearly all global markets are in the red.

The Nikkei in Japan led the markets down with a 3.4% drop as traders worried about the after-effects of twin earthquakes.

Shares in Toyota (TM) dropped 4.8% after the company said it would suspend production on various vehicle assembly lines in Japan because of a parts shortage caused by the quakes.

3. Earnings: It's time for more earnings from big U.S. companies.

Hasbro (HAS), Morgan Stanley (MS) and PepsiCo (PEP) are reporting ahead of the open.

IBM (IBM) and Netflix (NFLX) are reporting after the close.

Related: 20 stocks poised to crush earnings season

4. Stocks to watch -- Yahoo, Intel: Monday is reportedly the deadline for any final bids to acquire Yahoo (YHOO). Investors may not hear much officially about the bids, but information could begin to leak out. And the company will release earnings on Tuesday afternoon.

Intel (INTC) is in the spotlight Monday after a report that it's planning to lay off thousands of employees as soon as Tuesday, when the company releases earnings.

5. Brazil's crisis deepens: President Dilma Rousseff is a step closer to being ousted after lawmakers in the lower house of parliament voted for her impeachment on Sunday.

The impeachment motion will next go to the country's Senate. If a majority approves it there, Rousseff will have to step down for 180 days to defend herself in a trial. The Brazilian currency is holding steady on Monday.

6. Weekly market recap: Strong gains in the middle of last week gave a big boost to all the main U.S. indexes.

The Dow Jones industrial average and Nasdaq rose by 1.8% over the course of the week. The S&P 500 followed with a 1.6% gain.