So, you've probably just finished settling up your 2015 income tax bill with the IRS. (Or at least you should have, what with the due date being today and all.)

But unlike with other bills -- say, for groceries, utilities and clothes -- you may not be sure exactly what you just paid for.

The answer is: A lot of things.

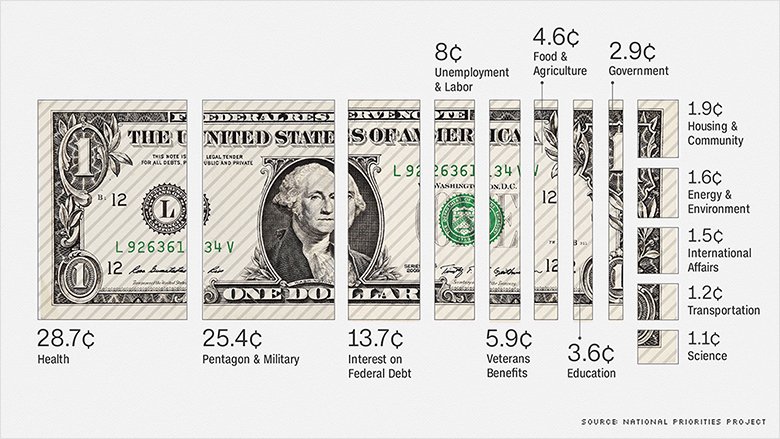

The National Priorities Project broke down how much of the $4.2 trillion federal budget last year was allocated to areas like defense, housing, education, science, and interest on the debt. Then it applied those percentages to the average American's federal tax bill.

The average household paid $13,000 in income taxes to Uncle Sam for 2015. Of that, the federal government spent:

- $3,728.92 (or 28.7%) on health programs

- $3,299.13 (or 25.4%) on the Pentagon and the military

- $1,776.06 (or 13.7%) on interest on the debt

- $1,040.93 (or 8%) on unemployment and labor programs

- $771.26 (or 5%) on veterans benefits

- $598.74 (or 4.6%) on food and agriculture programs

- $461.59 (or 3.6%) on education programs

- $377.50 (or 2.9%) on government expenses

- $250.03 (or 1.9%) on housing and community programs

- $207.68 (or 1.6%) on energy and environmental programs

- $194.29 (or 1.5%) on international affairs programs

- $150.68 (or 1.2%) on transportation funding

- $143.20 (or 1.1%) on science funding

Now that you've filed your federal income taxes, your total tax bill for 2015 should be fresh in your mind. If you want to know exactly how much of it went to each of these areas down to the penny, just plug the number into NPP's federal tax receipt calculator to find out.