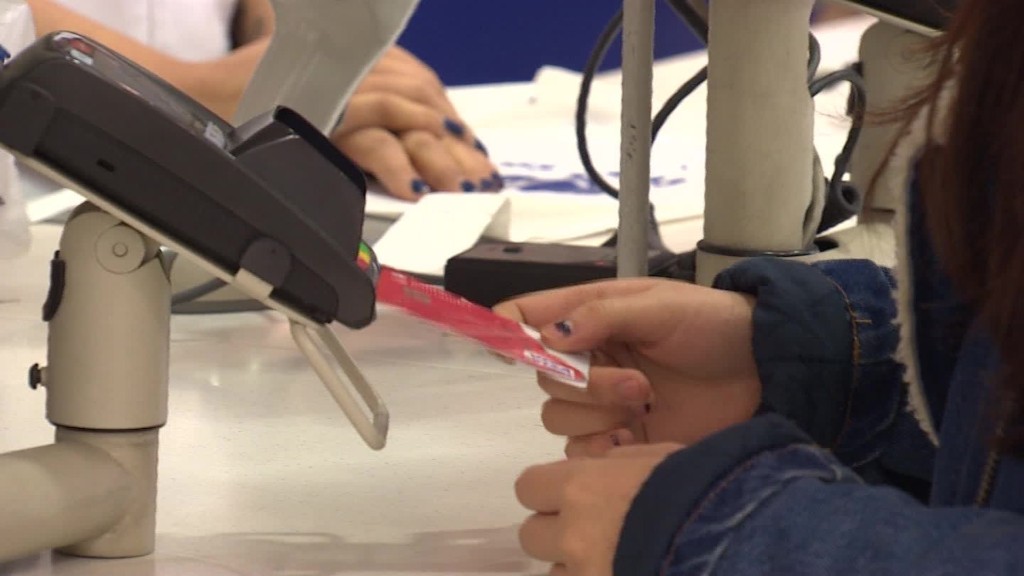

Visa is moving to fix one of the bigger complaints about its new chip-embedded credit cards: It takes too long to pay with them.

The credit card company said it is upgrading software which will allow consumers to insert and remove the card in two seconds or less, rather than to keep the card inserted in the card reader until the transaction is complete. Current chip card transactions can take 7 to 10 seconds on average, according to a study by merchant services provider Harbortouch.

Consumers used to simply swiping the magnetic strip on the back of the card have complained about the time it took to use the new chip. And nearly four times as many consumers are more worried about speedy processing times rather than chip card security, according to the survey by Harbortouch.

Having to leave the card in the reader while the entire transaction was processed also increases the risk that the card would be left behind by a consumer who is used to being able to put the card away immediately.

Visa (V) said the new process, which it dubs Quick Chip, should "make the checkout experience comparable to the ease and speed of magnetic stripe transactions."

But while other card issuers such as MasterCard (MA) and American Express (AXP) also have cards that use the chip, the new high speed checkout is so far only available for Visa credit and debit card holders.

Related: Don't fall for this chip card scam

The chips hold customers' payment data, as magnetic strips have long done. They also provide a unique code specific to each purchase, which is designed to cut down on hacking of cards by thieves.

The new chip readers are available at more than a million U.S. merchants, or about 20% of locations, according to Visa. Their use is widespread in Europe though, and has been for years.

Related: Just how safe is your new credit card?

With the new cards, banks are now holding merchants liable for credit card fraud if they continue to use swipe readers. Before the widespread introduction of the cards last fall, if a fraudster used a hacked credit card at a store, the bank usually covered the cost of the fraud.

The new process requires only a software update to the card reader and no change to the cards is required said Visa.