The United States routinely lives above its means by spending more than it takes in.

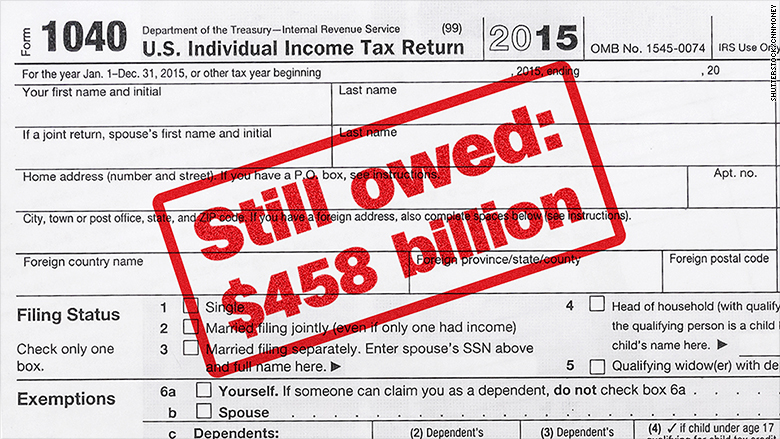

But that's not entirely intentional. Part of the problem is that every year there's an estimated $458 billion 'tax gap' -- taxes that are owed but not paid.

That's according to the latest estimate from the IRS. It's based on data from 2008 through 2010.

To put that amount of money in perspective, it represents about three-quarters of this year's projected budget deficit.

The IRS said it manages to recapture about $52 billion of that money through tax enforcement efforts like audits, which brings the net annual tax gap to $406 billion.

So, why the loss of so much revenue?

After all, Americans are famously good about paying their taxes. The United States has a voluntary compliance rate of 82%.

Related: What your 2015 income tax dollars paid for

The IRS cites three reasons for the persistent yawning gap: Underreporting, underpayment and failure to file, in that order.

Tax filers who underreport what they owe account for $387 billion of the gross tax gap. That's not all due to nefarious deception. People make mistakes or get confused by what are objectively confusing tax rules.

The biggest culprit in this regard is a lack of third-party reporting and tax withholding on some types of income -- such as that made by small businesses or made through rents and royalties.

The IRS noted that only about 1% of income reported by third parties and from which tax is withheld -- such as workers' pay -- is misreported.

But 63% of income for which there is little or no information reporting and withholding is misreported.

Money Essentials: What taxes do I owe?

Another way to break down the tax gap is to look at the different components of federal tax revenue.

Individual income taxes account for the biggest slice of the tax gap -- $319 billion. That includes income taxes from small businesses and partnerships.

Another $91 billion results from nonpayment of employment taxes, such as payroll taxes from the self-employed.

And $44 billion is the result of corporations' taxes owed but not paid.