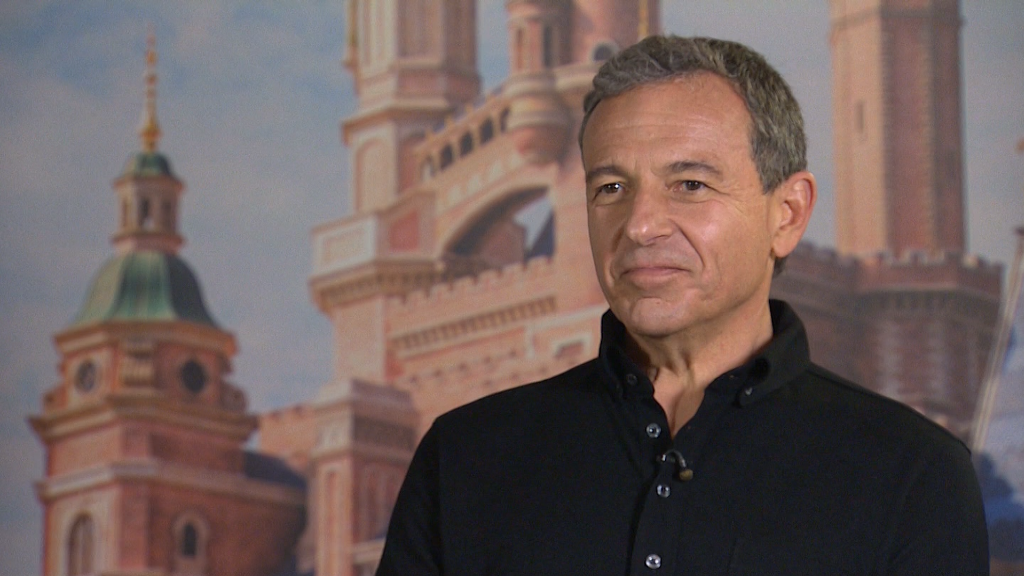

Disney CEO Bob Iger thinks companies -- including his -- are simply paying too much in tax to Uncle Sam.

Iger told CNNMoney on Thursday that high corporate tax rates in the U.S. are "anti-competitive," and described the country's tax system as "ridiculously complex."

"It doesn't mean that a company shouldn't pay taxes, but I think the structure is off ... the tax base should be lowered, and the loopholes should be closed," Iger said, without elaborating on potential reforms.

Related: Top 50 U.S. companies hold $1.4 trillion in cash offshore

Corporate taxes have been a flashpoint during the U.S. presidential campaign. Bernie Sanders, for instance, has lambasted big business for using loopholes to lower their tax bills.

Nearly 20% of large U.S. corporations that reported a profit on their financial statements in 2012 ended up paying exactly nothing in U.S. corporate income taxes, according to a recent report from the U.S. Government Accountability Office, which conducted its analysis at the behest of Sanders.

That's well below the 35% top corporate income tax rate.

Related: 20% of big companies pay zero corporate taxes

Sanders has specifically targeted Disney (DIS) in the past, accusing the company of exploiting workers and failing to pay them a living wage. The Democratic candidate has also called on the company to keep jobs in the U.S.

Related: Bob Iger fires back at Bernie Sanders: 'How many jobs have you created?'

Iger again rejected Sanders' arguments on Thursday, saying his company is a "positive for the United States and for the world."

"He chose the wrong company to criticize," Iger said. "I thought that it was indicative of a person who had never been in business and had not taken the time to really understand and appreciate what the meaning of business is to the country."

-- With reporting from Jeanne Sahadi.