TGIF.

Here are the five things you need to know before the opening bell rings in New York:

1. Jobs, jobs, jobs: The U.S. government just posted its highly anticipated August jobs report, showing the U.S. economy added 151,000 new jobs last month.

Economists surveyed by CNNMoney predicted the economy would add 175,000 jobs in August. This is well below the momentum seen in June and July, when the economy added over 250,000 jobs in each month.

But keep in mind, the August jobs report is known to be rather weak, based on historical reporting.

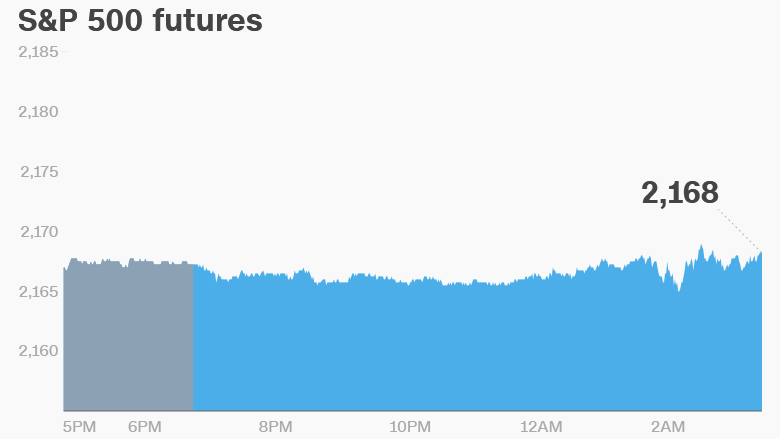

2. Stock market overview: U.S. stock futures are rising after the release of the jobs report.

Monthly employment data often moves markets, but this report took on extra significance because it's expected to play a big role in influencing whether the Federal Reserve hikes interest rates this year.

Janet Yellen, the chair of the Federal Reserve, signaled last week that a rate hike in 2016 is still on the table.

European markets are mostly rising in early trading. Asian markets ended the week with mixed results.

3. Tech talk -- Samsung, Apple: Samsung (SSNLF) has issued a worldwide recall for its new Galaxy Note 7 smartphone after reports of the device catching fire while charging.

The recall of one of Samsung's flagship devices is an embarrassing setback for the world's biggest selling smartphone maker. The Note 7 was unveiled just a month ago.

Shares in the company rose 0.6% Friday, before the company announced the recall.

Apple (AAPL) is also in the spotlight again over its Irish tax bill. The Irish government is appealing the European Commission's ruling that Apple owes the Irish government 13 billion euros in back taxes.

Ireland and Apple are accused of signing a sweetheart deal that allowed the company to artificially lower its tax bill.

4. Stocks to watch -- Lululemon, Carnival, Gap, Walmart, Smith & Wesson: Lululemon (LULU) shares are in a "downward-dog position," declining 8% premarket. Investors are hitting the sell button after the company reported quarterly earnings.

Shares in cruise ship operator Carnival (CCL) are dropping by about 4% premarket, though there's no clear catalyst for the move.

Gap (GPS) shares are dipping by about 2% premarket after the company posted a decline in sales in August.

Walmart (WMT) shares were on the move Thursday based on expectations for job cuts. The company confirmed after trading closed yesterday that it was cutting about 7,000 positions, but said affected employees would have the option to work in other roles.

And shares in gun maker Smith & Wesson (SWHC) could continue rising Friday after the company reported a 40% surge in quarterly sales and a doubling of profits from last year.

5. Thursday market recap: Market sentiment bounced around Thursday but things settled down by the end of the day.

The Dow Jones industrial average was up 0.1%, the S&P 500 stayed flat and the Nasdaq gained 0.3%.