Think you can't afford to save?

You're probably wrong. And a company called Digit is banking on it.

Part of the crop of new fintech companies designed to help Millennials manage their finances through technology, Digit helps you save by making very small and frequent withdrawals from your checking account. They're small enough so that you won't really notice the money is gone, but frequent enough to add up.

As time goes on, the algorithm learns your spending and income patterns and slowly adjusts the amount and frequency of withdrawals.

It stashes the savings into an FDIC-insured account that you can easily access with just a text, so no need to fear being cut off from your money.

Digit claims its algorithm is so good at figuring out what you can afford, it offers a no-overdraft guarantee.

Related: 6 things you can do right now that'll make you rich

When I first heard about Digit, I didn't think it was for me.

I'm a little too old to be considered a Millennial. Plus, I figured I wouldn't need much help since I've always been a pretty diligent saver. Putting away an extra $4.21 every now and then probably wasn't going to make a huge difference in my finances. But it's free, so what the heck.

Signup was pretty painless. I created an account using my name, email address, and cell phone number. From there I just had to link up my checking account and withdrawals started showing up a few days later.

At first, the amounts were tiny -- $3.94 here, $2.64 there. They were also pretty slow -- maybe once every several days. I remember thinking at this rate I might end up with $100 by the end of the year.

But eventually, the amounts increased to an average of $21, and sometimes as much as $90 if I happened to have a lot of cash sitting in my checking account. The withdrawals starting coming much faster too, about every 1-3 days.

Related: 10 best investing apps (and sites)

Digit would also send me daily texts with my bank account balance, greeting me with various salutations like "Konichiwa" and "Namaste," and even the occasional animated GIF thrown in to keep me interested. There's a way to adjust notifications if they're annoying, but I actually found the daily updates useful and sometimes amusing during my morning commute.

Digit isn't the only company using an automatic savings model. Other startups like Acorns and Betterment also integrate robo-saving features.

But those companies invest your money for you. Digit is purely focused on helping users meet short term goals and savings targets.

That said, the biggest drawback for me is that Digit acts as a savings account, but doesn't exactly pay interest. Instead, it offers a quarterly "savings bonus" of 5 cents for every $100 on your average balance. While still better than what some banks are paying these days, that's pretty low compared to a number of other ways to get a better return on your money.

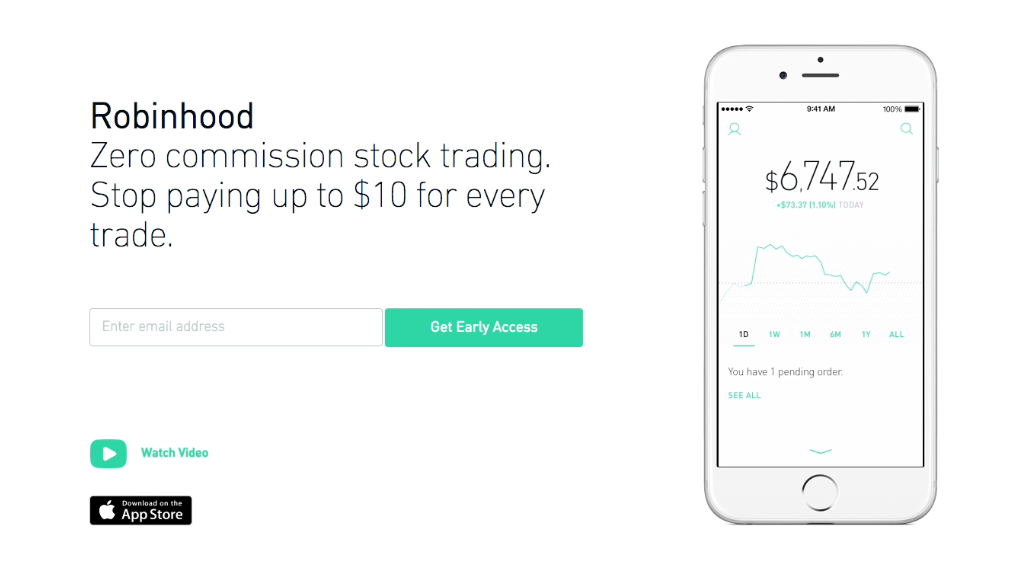

So I let my account grow for three months, collected my 13-cent bonus, and then transferred the money into my Robinhood account and invested it.

The company says that most users withdraw the majority of their savings every 90 days, so I guess I'm not alone.

Related: The easiest way to double your money

A little more than three months after I'd signed up, I had about $1,000 in my Digit account. Not exactly enough to quit my day job, but it's money that I wouldn't have had otherwise.

Now that I've invested the savings, it has the potential to grow even faster, and meanwhile, my Digit account keeps building.

I guess the takeaway is that many of us probably have a little extra change lying around in our budget for savings. Even me.