1. Time for a takeover: AT&T (T) and Time Warner (TWX) have agreed to an $85 billion takeover deal -- one of the biggest media tie-ups of all time if it is approved by regulators.

AT&T will pay $107.50 a share to buy Time Warner, which would help it expand beyond wireless and Internet service into programming. Time Warner is the parent of CNN, TNT, HBO, the Warner Bros. studio, and other channels and websites.

Reports of a potential mega-deal were circulating Friday, which pushed down AT&T shares and gave a massive boost to Time Warner.

The two companies will hold a joint call Monday with more details on the deal. AT&T is also releasing earnings ahead of the opening bell. Time Warner stock is set to continue rising Monday.

2. Speaking of earnings: Kimberly-Clark (KMB), Philips (PHG), T-Mobile (TMUS) and Restaurant Brands International (QSR), which owns Burger King and Tim Hortons, are all reporting results ahead of the open.

Visa's (V) quarterly earnings -- which are coming after the close of trading -- will show how much its deal with Costco is paying off.

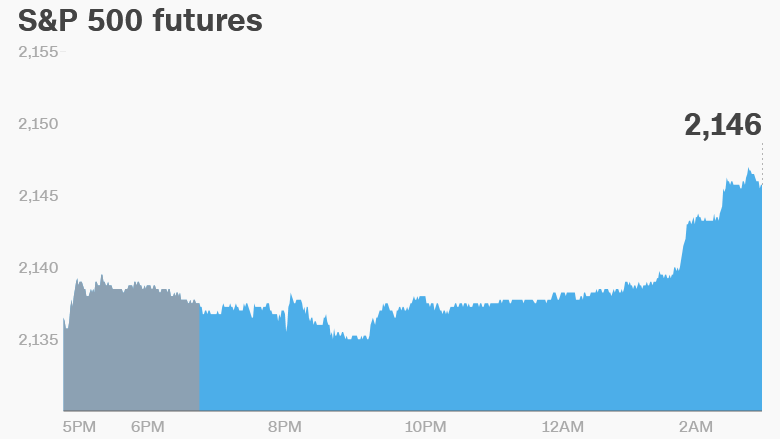

3. Global market overview: Stock markets are looking pretty perky on Monday.

U.S. stock futures are all pushing up. European markets are also rising in early trading. And Asian markets ended the day with gains.

The only major market to be in the red on Monday was Australia, which dipped by 0.5%.

4. Weekly market recap: U.S. stocks had a bit of a bumpy ride last week, but mostly ended in positive territory.

The S&P 500 and Nasdaq rose by 0.4% and 0.8%, respectively. The Dow Jones industrial average ended the week essentially unchanged.

5. Coming this week:

Monday - AT&T and Time Warner call and AT&T earnings, Visa earnings

Tuesday - Apple, GM (GM), Fiat-Chrysler (FCAU) and Chipotle (CMG) earnings

Wednesday - Southwest Airlines (LUV), Nintendo, Airbus, Boeing, Coca-Cola (KO) earnings

Thursday - Apple's Mac reveal; Alphabet, Samsung, Amazon (AMZN), Twitter, Ford, UPS (UPS), ConocoPhillips (COP) earnings

Friday - MasterCard (MA) and Anheuser-Busch (BUD) earnings, third-quarter U.S. GDP