President-elect Donald Trump is stacking his administration with members of the rich business elite, many of whom will likely be required to sell off some of their assets to avoid conflicts of interest.

But a provision in the tax code could give Trump's Cabinet nominees a hefty financial break on anything they are forced to divest.

Any person who is compelled by federal law to get rid of problematic holdings can take advantage of the rule, which is outlined under section 1043 of the Internal Revenue Code.

It allows those people to defer paying capital gains tax on any sale as long as they reinvest their money in certain types of investments permitted by the government, like U.S. Treasuries or highly diversified mutual funds.

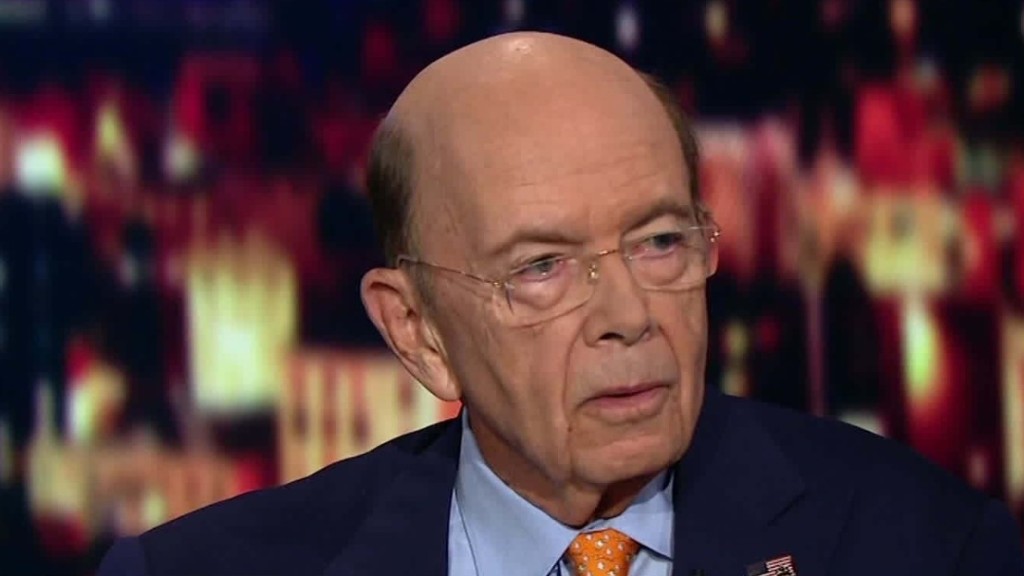

That could be a huge perk for people like Commerce secretary nominee Wilbur Ross, a billionaire investor, and Treasury secretary pick Steven Mnuchin, a former Goldman Sachs partner who until last week sat on the board of a multibillion-dollar financial holding company. While the full extent of their holdings isn't yet known, they could be required to divest anything tied to the industries they will be working closely with or regulating.

Related: Trump assembles a team of billionaires

The law doesn't necessarily mean government executives who use it avoid paying taxes forever, said Kenneth Gross, a partner at the law firm Skadden, Arps, Slate, Meagher & Flom who has provided legal assistance to several presidential campaigns.

If a Cabinet appointment sells the government-approved investment after leaving office, for example, he or she would pay the gain.

"You pay the capital gains rate that's applicable at the time that you sell," Gross said in an interview with CNNMoney last month. "You're not avoiding tax, you're just saying, 'I don't have to pay it now.'"

The law, essentially, is an incentive for nominees who leave lucrative private sector jobs for public service -- a free way to diversify their holdings.

And even if an executive wants to pull their money out of the government-approved fund after leaving office, the initial tax deferral can carry a financial benefit, since the longer the taxes are put off, the larger the balance that remains invested and the faster the money can compound.

One example of this type of divestiture is Henry Paulson, the Goldman Sachs CEO who in 2006 was nominated by President George W. Bush for Treasury secretary. Before he could take the job, Paulson was forced to unload about $500 million worth of Goldman stock.

--CNNMoney's Jeanne Sahadi contributed to this report.