1. Preparing for a big week: Wall Street is preparing for what is expected to be a very big week.

The U.S. Federal Reserve is expected to hike interest rates, German Chancellor Angela Merkel will meet President Trump and The Netherlands is holding a closely-watched election. Plus, the U.K. could formally trigger Brexit negotiations.

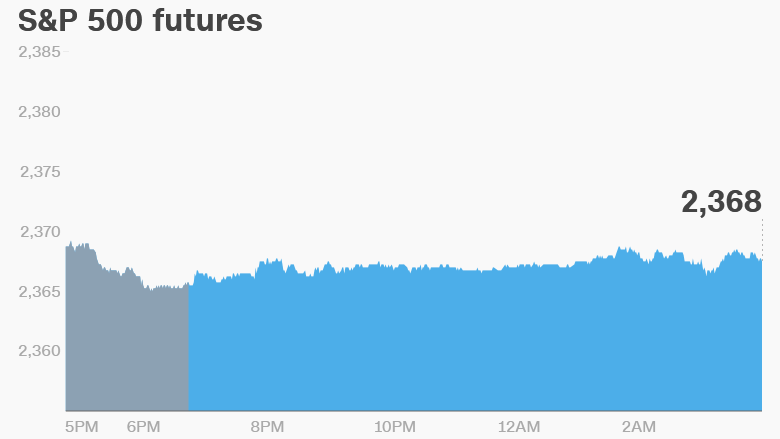

U.S. stock futures were holding steady ahead of the open.

The key company moving New York markets before trading begins is Mobileye (MBLY) -- shares are set to surge by more than 30% after Intel (INTC) confirmed it's buying the Israeli tech firm for $15.3 billion

European markets were mostly higher in early trading, supported by a rally in mining stocks. In London, shares in Anglo American (AAUKF) and Rio Tinto (RIO) surged by about 3% to 4%.

In Asia, most stock markets ended higher.

The Dow Jones industrial average, S&P 500 and Nasdaq all turned in lackluster performance last week, with each posting declines of 0.2% to 0.5%. However, they're still not far from all-time highs set in early March.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

2. Slippery oil: Keep an eye on oil prices.

Crude oil futures are slipping to trade just below $48.50 per barrel. The price is down 10% since the start of the year.

Crude prices had strengthened after OPEC and other major producers agreed in November to slash production. But there are concerns about whether this new status quo will hold for long, especially as U.S. shale oil producers ramp up their production levels.

OPEC and the International Energy Agency will publish reports this week with data on production levels.

Download CNN MoneyStream for up-to-the-minute market data and news

3. Coming this week:

Monday - CBO releases score for House Republicans' health care bill

Tuesday - Federal Reserve meeting kicks off; Toshiba (TOSYY) and Hostess Brands (TWNK) report earnings

Wednesday - Fed expected to announce rate hike; Election in The Netherlands

Thursday - Trump travel ban takes effect; Dollar General (DG) reports earnings

Friday - G20 meeting for finance ministers and central bankers