Here are two shockers: Big Oil wants to tax itself to fight climate change. And it wants the proceeds to go to American families.

Major oil companies including ExxonMobil (XOM), BP (BP), Royal Dutch Shell (RDSA) and Total (TOT) backed a carbon tax proposal on Tuesday that has been gaining traction in Washington.

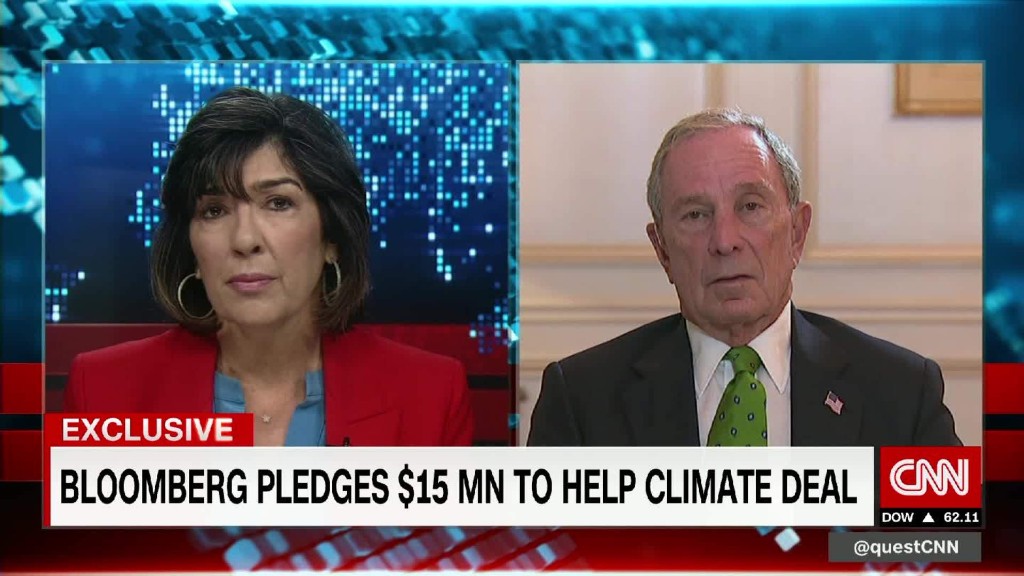

Other big-name backers include billionaire former New York City mayor Michael Bloomberg, physicist Stephen Hawking and former U.S. Treasury Secretary Larry Summers.

The plan has found support after President Trump announced that he would exit the Paris climate accord, isolating the U.S. from global efforts to reduce carbon emissions and limit rising temperatures.

The Climate Leadership Council, which helped assemble the unusual coalition, ran an advertisement in the Wall Street Journal on Tuesday that described the proposal as "pro-environment, pro-growth, pro-jobs, pro-competitiveness, pro-business and pro-national security."

The ad also described the plan as embodying "the conservative principles of free markets and limited government."

Here's how the plan would work:

Companies would be taxed on the carbon dioxide generated by mining, drilling and other activities conducted in the U.S. The fee would start around $40 per ton and go up from there.

The tax proceeds would then be paid out to Americans -- regardless of income level -- in monthly installments through the Social Security Administration.

The Climate Leadership Council said the carbon tax could generate an estimated $2,000 for a family of four in its first year.

Companies would get a rebate when they export products abroad in order to ensure a level global playing field.

Products imported into the U.S. would also be taxed based on their carbon content. Proceeds from this "border adjustment tax" would be paid directly to Americans.

The group also suggests that some environmental regulations won't be needed if the tax on carbon emissions is high enough.

Related: The prize for doing business better: $12 trillion

Writing in the Washington Post on Tuesday, Summers and former secretary of state George Shultz argued that the plan addresses Trump's concerns about the Paris accord by ensuring that American firms are not put at a disadvantage. They assured skeptics that "our long experience in Washington has taught us that the transition from the inconceivable to the inevitable can sometimes be very rapid."

The proposal is not likely to win support from all corners. The cost of the tax could be passed from companies to consumers, and some environmentalists argue that market forces are no substitute for effective regulation when it comes to reducing carbon emissions.

"ExxonMobil will try to dress this up as climate activism, but its key agenda is protecting executives from legal accountability for climate pollution and fraud," Greenpeace campaigner Naomi Ages said.

Related: Solar energy is killing coal, despite Trump's promises

Analysts also say the plan would be very difficult to implement.

"Viewed in glorious isolation from the rest of the world, it has a lot going for it," said Gregor Irwin, chief economist at strategic advisory firm Global Counsel. "But as soon as you start looking at how they propose to make it work [with other parts of the world] ... it becomes really complicated and really messy."

Irwin said that it would, for example, be hard to calculate fair carbon taxes on imports ranging from oil to cars to semiconductors.

The plan also requires political backing and federal legislation, a process that could take years.

"It may take another presidential election for this to be fully enacted," said Ted Halstead, who leads the Climate Leadership Council.

Halstead, who helped bring Big Oil on board, said he would like to see the U.S. government move ahead with the carbon tax, but other countries like France, China or the U.K. could take the lead instead.

"The idea could be started in any country," he said, noting that enacting the rules in one nation could lead to a "domino effect."

The Climate Leadership Council published a list of companies and prominent individuals who supported the carbon tax plan on Tuesday. Here are some other notable backers:

General Motors (GM)

Johnson & Johnson (JNJ)

Procter & Gamble (PG)

Pepsi (PEP)

Unilever (UL)

Hedge fund titan Ray Dalio

Indian industrialist Ratan Tata