1. Terror attacks hit travel stocks: Shares in European airlines and tour operators are falling after a spate of terror attacks rocked Spain, killing or injuring people from 24 countries.

Air France (AFLYY), British Airways owner IAG (ICAGY), easyJet (ESYJY) and Ryanair (RYAAY) all fell by more than 3% in early trading. Shares in German carrier Lufthansa (DLAKY) fell by 2.5%. Tour operator Thomas Cook shares fell by a similar amount.

Hotel groups Accor (ACCYY), InterContinental (IHG) and Melia Hotels (SMIZF) are slipping too, down by between 1% and 2%.

American-traded airlines and hotels dropped sharply on Thursday after the first attack in Barcelona: JetBlue (JBLU) and Delta Air Lines (DAL) were the worst hit, down by 5.2% and 6.1%, respectively.

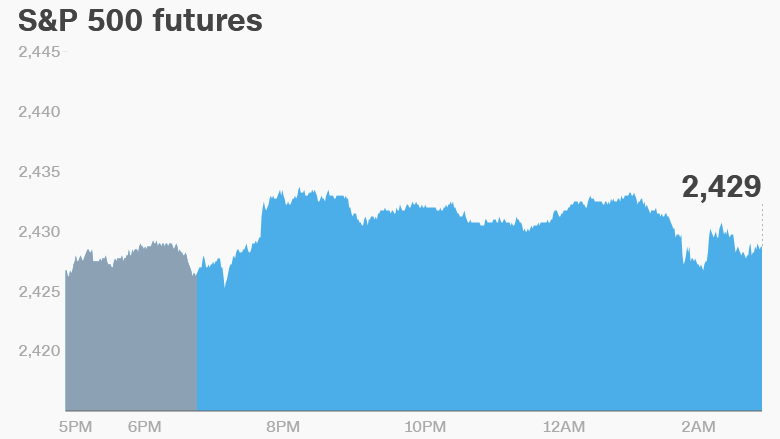

2. Global market overview: The latest attacks are weighing on markets across the world. U.S. stock futures were lower early on Friday.

All major European markets slumped at the open. The main stock market in Madrid dropped almost 1.2%, while London's FTSE 100 and Germany's DAX were both down by 0.9%. Asian markets also ended the session lower.

The VIX volatility index surged more than 30% on Thursday, before easing a little on Friday. CNNMoney's Fear & Greed index of market sentiment is back in "extreme fear" territory.

U.S. markets dropped sharply on Thursday. The Dow Jones industrial average fell 1.2%, with all 30 of the stocks in the index in the red. It was the biggest decline for the Dow since May. The S&P 500 was down 1.5% and the Nasdaq was down 1.9%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Stock market movers: Ross Stores Inc (ROST) was up 11.5% in extended trading, while Gap (GPS) was up 6.3%. Both retailers reported upbeat earnings on Thursday.

Shares in Infosys (INFY), one of India's biggest outsourcing firms, were down as much as 12% in Mumbai on Friday. CEO Vishal Sikka is stepping down after months of tension with the company's founders.

4. Companies and economics: Estee Lauder (EL) and Foot Locker (FL) plan to release their earnings before the open Friday. Foot Locker shares were slightly down in premarket trading.

The University of Michigan will release preliminary data for consumer confidence in August at 10 a.m. ET. The closely monitored monthly survey gives a good sense of whether American consumers are willing to spend money.

In January, when Trump was inaugurated, consumer confidence reached 98.5 -- the highest level in more than a decade. Confidence soared on hopes that Trump would cut taxes, reduce regulations and spend on infrastructure. Those plans have stalled, and consumer confidence fell to 93.4 in July.

Download CNN MoneyStream for up-to-the-minute market data and news

5. Coming this week:

Friday -- University of Michigan releases consumer confidence report for August