One tax break on the chopping block in the House Republicans' tax reform bill -- alimony payments.

The legislation, which was made public Thursday, would eliminate the tax deduction that divorcees receive on their payments to ex-spouses.

These payments, typically codified in the terms of a divorce settlement, are different than child support and are usually referred to as alimony or spousal support.

If the GOP tax bill passes as written, the change would affect divorces carried out after December 31. So it wouldn't affect anyone already paying alimony.

Lawyers say it would have a big impact on how divorce proceedings play out.

Related: What's in the House tax bill for people

Avoiding taxes on alimony payments has made them easier to stomach for the divorcees paying them out.

Without the deduction, wealthier spouses may be less willing to agree to pay alimony in divorce settlements, said Malcolm Taub, who's worked as a divorce attorney for nearly three decades.

Just how important are alimony negotiations in a divorce proceeding? Very, says Taub.

"A divorce lawyer has certain tools in their toolbox in order to settle a case and render a judgment," he said. "One of the most significant tools in this toolbox is the tax deduction for spousal payments."

Related: House tax plan would kill the student loan interest deduction

The vast majority of divorce settlements include some sort of spousal payment provision, Taub said. And if couples are less likely to reach an agreement on alimony terms, divorce proceedings could become more gridlocked, time consuming and expensive.

Michael Beyda, a divorce attorney based in New York, agreed with Taub's assessment.

"Spousal support is a very common aspect of any divorce negotiation," Beyda said. "This will change the landscape."

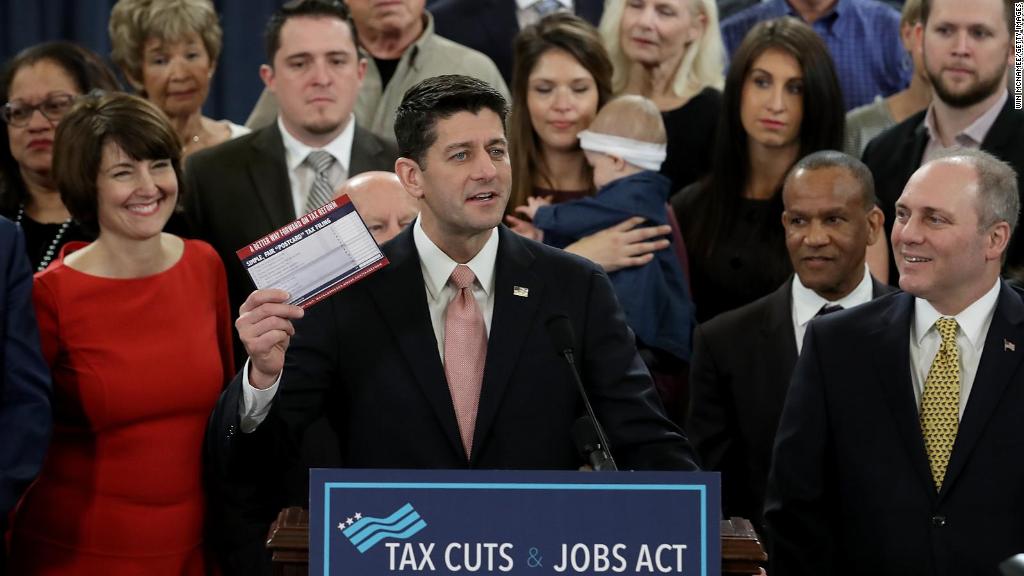

The alimony deduction repeal is just one provision among hundreds tucked away in the House GOP's 429-page tax reform bill. Among the most significant measures: Narrow the number of tax brackets from seven to four and nearly double standard deductions.

The bill still needs to be approved by the House and Senate. Then, it needs a sign off from President Trump, who has said it will be done "before Christmas."