Medicare enrollees, who have watched their out-of-pocket spending on prescription drugs climb in recent years, might be in for a break.

Federal officials are exploring how beneficiaries could get a share of certain behind-the-scenes fees and discounts negotiated by insurers and pharmacy benefit managers, or PBMs, who together administer Medicare's Part D drug program. Supporters say this could help enrollees by reducing the price tag of their prescription drugs and slow their approach to the coverage gap in the Part D program.

The Centers for Medicare & Medicaid Services (CMS) could disclose the fees to the public and apply them to what enrollees pay for their drugs. However, there's no guarantee that such an approach would be included in a proposed rule change that could land any day, according to advocacy groups, such as the National Association of Specialty Pharmacy and the National Community Pharmacists Association.

"It's obvious something has to be done about this. This is causing higher drug prices for patients and taxpayers," Rep. Earl "Buddy" Carter, a pharmacist from Georgia, said this week.

Related: Trump administration opens door for states to impose work requirements

While Medicare itself cannot negotiate drug prices, the health insurers and PBMs have long been able to negotiate with manufacturers who are willing to pay rebates and other discounts so their products win a good spot on a health plan's list of approved drugs.

Federal officials described these fees in a January fact sheet as direct and indirect remuneration, or DIR fees.

In recent years, pharmacies and specialty pharmacies have also begun paying fees to PBMs. These fees, which are different than the rebates and discounts offered by manufacturers, can be controversial, in part, because they are retroactive or "clawed back" from the pharmacies.

The controversy is also part of the reason advocates, such as pharmacy organizations, have lobbied for this kind of policy change.

PBMs have long contended that they help contain costs and are improving drug availability rather than driving up prices.

Related: House tax bill could scrap deduction for medical costs

Pressure has been building for the administration to take action. Earlier this year, the federal agency's fact sheet described how the fees kept Medicare Part D monthly premiums lower but translated to higher out-of-pocket spending by enrollees and increased costs to the program overall.

In early October, Carter led a group of more than 50 House members in a letter urging Medicare to dedicate a share of the fees to reducing the price paid by Part D beneficiaries when they buy a drug. Also in the House, Rep. Morgan Griffith of Virginia introduced a related bill.

On the Senate side, Chuck Grassley of Iowa and 10 other senators sent a letter in July to CMS Administrator Seema Verma, as well as officials at the Department of Health and Human Services asking for more transparency in the fees — which could lead to a drop in soaring drug prices if patients get a share of the action.

Verma responded last month that the agency is analyzing how altering DIR requirements would affect Part D beneficiary premiums -- a key point that muted previous political conversations.

But advocates say the tone of discussions with the agency and on Capitol Hill have changed this year. That's partly because Medicare beneficiaries have become more vocal about their rising out-of-pocket costs, increasing scrutiny of these fees.

Ellen Miller, a 70-year-old Medicare enrollee in New York City, saw her prescription prices go up this year, sending her into the Medicare "doughnut hole" by April. With coverage, Miller pays about $200 a month for several prescriptions that help her cope with COPD, or chronic obstructive pulmonary disease, as well as another chronic illness.

In the doughnut hole, where coverage drops until catastrophic coverage kicks in, her out-of-pocket costs climb to $600 a month.

It's "ridiculous, and that doesn't count my medical bills," Miller said.

The number of Medicare Part D enrollees with high out-of-pocket costs, like Miller, is on the rise. And in 2015, 3.6 million Medicare Part D enrollees had drug spending above the program's catastrophic threshold of $7,062, according to a report released this week by the Kaiser Family Foundation. (Kaiser Health News is an editorially independent program of the foundation.)

Supporters of the rule change say making the fees more transparent and applying them to what enrollees pay would provide relief for beneficiaries like Miller.

Related: 5 changes for Obamacare open enrollment

The Pharmaceutical Care Management Association (PCMA), which represents the PBMs who negotiate the rebates and discounts, says changing the fees would endanger the Part D program.

"Why anybody would choose to destabilize the program is beyond me," said Mark Merritt, president and chief executive of PCMA.

CMS declined to comment on a reference to a pending rule change, which was posted in September.

For now, though, according to the CMS fact sheet, the fees pose two compounding problems for seniors and the agency:

-- Enrollees pay more out-of-pocket for each drug, causing them to reach the program's coverage gap quicker. In 2018, the so-called doughnut hole begins once an enrollee and the plan spends $3,750 and ends at $5,000 out-of-pocket, and then catastrophic coverage begins.

-- Medicare, thus taxpayers, pays more for each beneficiary. Once enrollees reach the threshold for catastrophic coverage, Medicare pays the bulk cost of the drugs.

CVS Health, one of the nation's top three PBMs, released a statement in February calling the fees part of a pay-for-performance program that helps improve patient care. The fees, CVS noted, are fully disclosed and help drive down how much Medicare pays plans that help run the program.

"CVS Health is not profiting from this program," the company noted.

Express Scripts, also among the nation's top three PBMs, agreed that the fees lower costs and give incentives for the pharmacies to deliver quality care. As for criticism from the pharmacies, Jennifer Luddy, director of corporate communications for the company, said, "We're not administering fees in a way that penalizes a pharmacy over something they cannot control."

Related: Nursing homes benefiting from Medicaid loophole

Regardless, there is some question as to how easily the fees can translate into lower costs for seniors, in part because the negotiations are so complicated.

When the Medicare Payment Advisory Commission, which provides guidance to Congress, discussed the negotiations in September, Commissioner Jack Hoadley thanked the presenters and said, "In my eyes, what you've revealed is a real maze of financial ... entanglements."

Tara O'Neill Hayes, deputy director of health care policy at the conservative American Action Forum, said passing on the discounts and fees to beneficiaries when they buy the drug could be difficult because costs crystallize only after a sale has occurred.

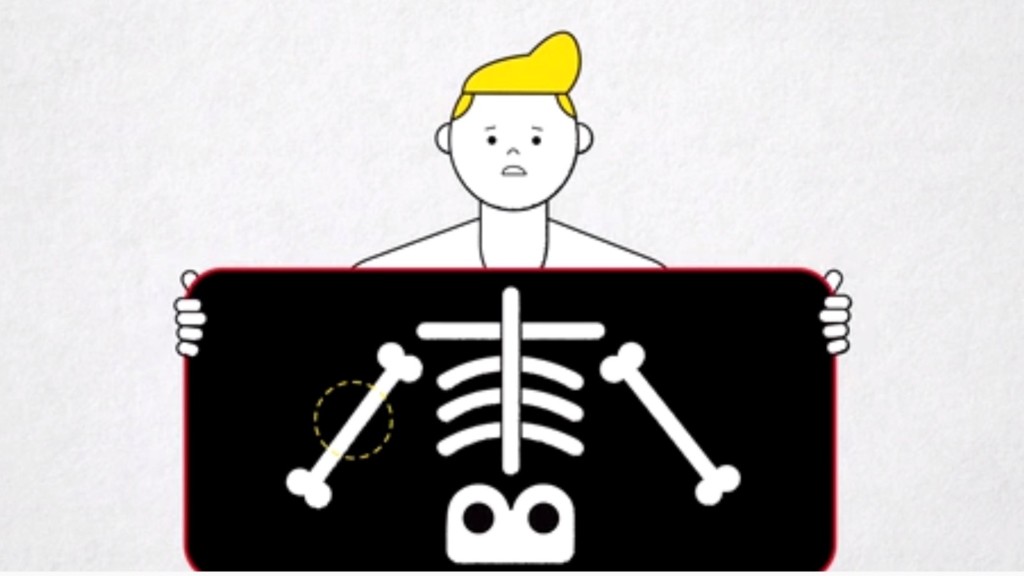

"They can't be known," said Hayes, who created an illustration of the negotiations. "There's money flowing many different ways between many different stakeholders," Hayes said.

Kaiser Health News, a nonprofit health newsroom whose stories appear in news outlets nationwide, is an editorially independent part of the Kaiser Family Foundation.