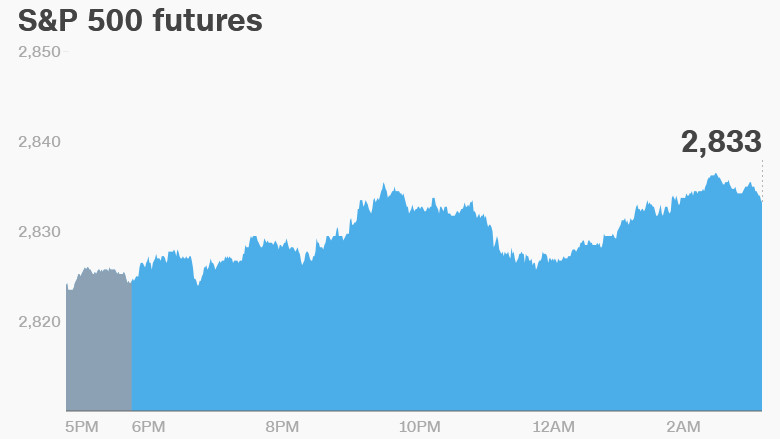

1. Stocks stabilize: U.S. stock futures were higher on Wednesday after two very rough trading sessions on Wall Street.

The Dow Jones industrial average dropped by 1.4% on Tuesday, its worst performance since May. The S&P 500 fell 1.1% and the Nasdaq shed 0.9%.

The losses were driven by a sell off in health care stocks and concerns about the bond market.

European markets were mostly positive on Wednesday. Many Asian markets ended the day with losses.

2. Fed watch: The U.S. Federal Reserve will announce its latest interest rate decision at 2 p.m. ET. Rates are expected to remain unchanged.

"The focus ahead of the meeting has been on the extent to which the Fed will acknowledge the recent rise in inflation pressure and inflation expectations," said Felix Ewert of Swedish bank SEB.

Fed chair Janet Yellen is overseeing her final Federal Open Market Committee meeting. She will relinquish her post to Jerome Powell on February 3.

Powell is expected to continue slowly lifting interest rates.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Earnings galore: Anthem (ANTM), Boeing (BA), Eli Lilly (LLY), Energizer (ENR), Sirius XM Radio (SIRI) and Tupperware (TUP) will publish earnings before the open.

AT&T (T), eBay (EBAY), Facebook (FB), Microsoft (MSFT), Mondelez International (MDLZ), PayPal (PYPL), Qualcomm (QCOM) and Symantec (SYMC) will follow after the close.

4. Blackstone's big deal: Private equity firm Blackstone has agreed to buy a majority stake in Thomson Reuters' financial and risk unit for $17 billion, putting it in direct competition with Bloomberg.

Bloomberg and Thomson Reuters provide financial data and other services to bankers, investors and regulators.

Thomson Reuters (TRI) will retain a 45% stake in the data unit. The group also owns a major international news operation and a unit that specializes in legal and tax and accounting services.

5. Market movers -- Electronic Arts, Xerox, Capita: Shares in Electronic Arts (EA) jumped 7% in extended trading after the company reported quarterly results on Tuesday.

Shares in Xerox (XRX) were also up 7% premarket after the company reported a new deal with Fujifilm (FUJIF), as well as layoffs and quarterly results.

Shares in the London-traded firm Capita (CTAGY) dropped 40% after the government contractor announced it was suspending its dividend payouts, raising fresh investment and selling off some units.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Wednesday -- Earnings from Anthem (ANTX), AT&T (T), Microsoft (MSFT), eBay (EBAY), PayPal (PYPL), Mondelez (MDLZ) and Facebook (FB)

Thursday -- Earnings from Apple (AAPL), Alphabet (GOOGL), Amazon (AMZN), Time Warner (TWX), Hershey (HSY), UPS (UPS), MasterCard (MA), Visa (V), Mattel (MAT), DowDuPont (DWDP) and ConocoPhillips (COP)

Friday -- U.S. monthly jobs report