1. Deutsche Bank drama: The CEO of Deutsche Bank (DB), Germany's biggest lender, is out.

John Cryan, who has led the embattled bank for less than three years, will be replaced by Christian Sewing at the end of the month.

The bank's shares opened 3% higher on Monday.

Deutsche Bank posted an annual loss for 2017 of €500 million ($610 million). That followed losses of €1.4 billion ($1.7 billion) for 2016 and €6.8 billion ($8.4 billion) for 2015.

Cryan closed hundreds of bank branches and axed tens of thousands of jobs, but his efforts haven't been enough to bring the company back into the black.

2. Big pharma deal: Novartis (NVS) announced plans to buy AveXis (AVXS), a Nasdaq-listed clinical stage gene therapy company, for $8.7 billion in cash.

Novartis said the deal will strengthen its position in neurodegenerative diseases therapy. It expects the transaction to close in the middle of this year.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

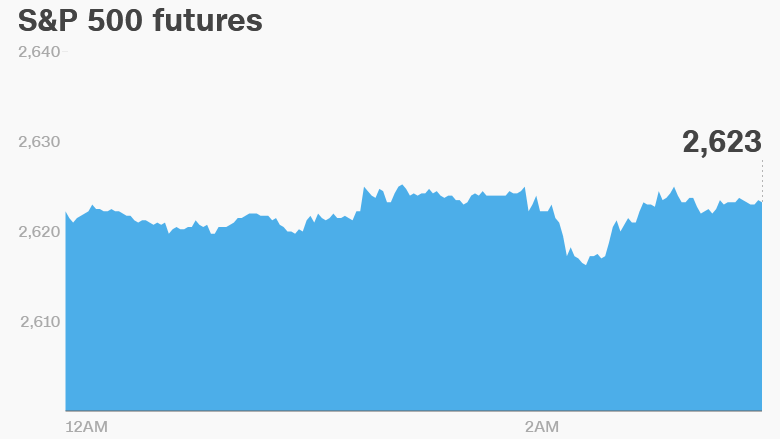

3. Markets calmer, for now: US stock futures were pointing higher on Monday after President Donald Trump appeared to soften some of his trade rhetoric.

"President Xi and I will always be friends, no matter what happens with our dispute on trade," Trump tweeted on Sunday. "China will take down its Trade Barriers because it is the right thing to do."

Trump said last week that he could impose new tariffs on $100 billion worth of Chinese goods, a pronouncement that rattled markets. China responded by saying that it doesn't want "to fight a trade war, but we are not afraid of fighting it."

The Dow Jones industrial average is back in correction territory, meaning it is 10% below its recent high. The index closed down 2.3% on Friday, while the S&P 500 shed 2.2% and the Nasdaq lost 2.3%.

4. Global market overview: Major European and Asian markets were all higher on Monday. US Crude Futures edged 0.4% higher to trade at $62.30.

Gold was 0.3% lower. The metal is seen as safe haven and its price has mirrored swings in the stock markets.

5. Companies and economics: The Sequoia Fund has purchased what it describes as a small position in Facebook (FB) toward the end of the first quarter.

In a letter to investors and clients, the fund's managers said that while Facebook "committed sins for which it must now atone," they believe the social media company remains "far more competitive and faster-growing enterprise than the average American business."

The US Congressional Budget Office will release its annual Budget and Economic Outlook at 2:00 p.m. ET.

German exports declined 3.2% in February over the previous month, according to official data. The country exported €19.2 billion ($23.6 billion) more goods and services than it imported during the month.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Monday — CBO budget outlook

Tuesday — Equal Pay Day; Zuckerberg testifies; PPI

Wednesday — Zuckerberg testifies; Fed minutes; CPI; Bed Bath & Beyond earnings

Thursday — BlackRock, Delta, Rite Aid earnings

Friday — Citi, JPMorgan, PNC, Wells Fargo earnings