1. Trade war fears ease: China said Sunday it would "welcome" direct trade talks with the United States, a day after US Treasury Secretary Steven Mnuchin said he would consider a trip to China.

Mnuchin said he was "cautiously optimistic" the United States could broker a trade deal with Beijing.

The world's two biggest economies have threatened each other with tariffs, rattling financial markets.

Meanwhile, Mexico and the European Union agreed a new trade deal over the weekend. The deal removes virtually all tariffs on goods, and marks a move by Mexico to reduce its reliance on trade with the United States.

It also opens the door for companies in the European Union or Mexico to bid for government contracts in the other.

2. UBS dips: Shares in UBS (UBS) dropped as much as 4.4% in early trade in Zurich on Monday.

The bank posted earnings for the first quarter that beat forecasts, but investors focused on a weaker than expected performance by its global private wealth management division.

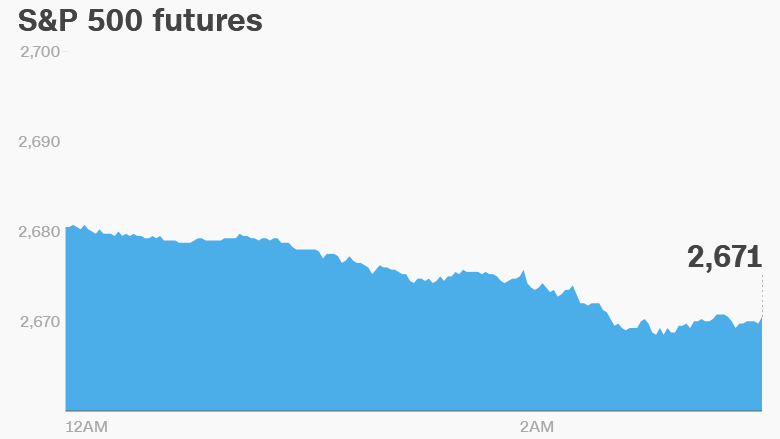

3. Global market overview: US stock futures were dipping lower early on Monday.

European markets opened mostly down, following a negative session in Asia.

The Dow Jones industrial average shed 0.8% on Friday, while the S&P 500 lost 0.9%. The Nasdaq was 1.3% lower.

US crude oil futures dipped 0.8% early on Monday, trading at $68 per barrel.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

4. Earnings and economics: Alaska Air (ALK), Halliburton (HAL), Hasbro (HAS), Kimberly-Clark (KMB), and Philips (PHG) are set to release earnings before the open Monday. Alphabet (GOOG), the owner of Google, Sallie Mae (SLM), TD Ameritrade (AMTD), and Whirlpool (WHR) will follow after the close.

The Existing Home Sales report for March is set to be released at 10 a.m. ET.

Surveys of business confidence in manufacturing and services came in slightly above expectations in Germany and France.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

5. Coming this week:

Monday — Alphabet, Hasbro, Kimberly-Clark and Whirlpool earnings

Tuesday — Caterpillar, Coca-Cola, Jetblue (JBLU), Lockheed Martin, Restaurant Brands (QSR), Southwest, Verizon and Wynn Resorts earnings; Conference Board's consumer confidence index

Wednesday — AT&T, Boeing, Chipotle, Comcast, Dr Pepper Snapple, Facebook and Twitter earnings

Thursday — Time Warner, American Airlines, Dunkin' Brands, General Motors, PepsiCo, Starbucks and Southwest earnings

Friday — Exxon earnings; Q1 GDP