1. Trade fears deepen: Trade tensions between the United States and some of its biggest trading partners continue to escalate.

China said President Donald Trump's plan to impose tariffs on $50 billion of Chinese exports threatens to wipe out recent progress made in trade talks between Beijing and Washington.

The latest round of negotiations between the world's two biggest economies ended on Sunday with China making it clear that it would not deliver on commitments to buy more American goods if its exports are sanctioned.

Meanwhile, Canada has called Trump's decision to impose aluminum and steel tariffs on America's closest allies -- Canada, Mexico and the European Union -- an insult.

"Please think hard about the message you're sending to your closest allies," Canadian foreign minister Chrystia Freeland told CNN on Sunday.

The European Union has slammed Trump for "pure protectionism" and readied tariffs on bourbon, motorcycles and dozens of other American products. Mexico has also announced it would place tariffs on American exports.

2. Apple's big show: Apple's Worldwide Developers Conference begins on Monday, featuring presentations from CEO Tim Cook and his top lieutenants.

They'll showcase Apple's latest software and the next version of macOS.

Investors watch WWDC closely to determine what kind of features Apple (AAPL) might include in the next iPhone — by far the company's biggest cash cow. Apple typically unveils its iPhones in the fall.

3. Aviation headwinds: Airlines are in focus as the International Air Transport Association, a global industry group, gathers in Sydney for its annual conference.

The meeting kicked off on a cautious note, as the organization slashed its forecast for industry profits in 2018 by 12% to $33.8 billion.

IATA said rising costs, primarily fuel and labor, but also the upturn in the interest rate cycle, are behind the lower forecast.

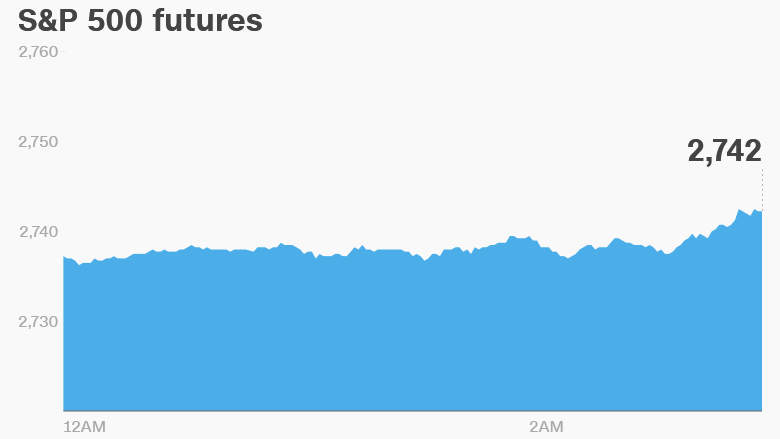

4. Global market overview: US stock futures were higher.

European markets posted gains, continuing the trend set in Asia.

Markets surged Friday after better than expected US jobs report. The Dow Jones industrial average added 0.9%, while the S&P 500 gained 1.1% and the Nasdaq surged 1.5%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Company news: Palo Alto Networks (PANW) will release earnings before the open.

Microsoft (MSFT) could announce as soon as on Monday that it is buying GitHub, according to Bloomberg. Github hosts open-source software for developers.

Shares in Commonwealth Bank of Australia (CBAUF) gained 1.4% after it agreed to pay 700 million Australian dollars ($534 million) for breaching anti-money laundering and counter-terrorism financing laws. If agreed by the Federal Court it will represent the largest ever civil penalty in Australian corporate history.

En+ Group announced that its president, Maxim Sokolov, has resigned. The company has been hard hit by US sanctions targeting Russian oligarch owner Oleg Deripaska.

Shares in Italy's UniCredit (UNCFF) and French rival Societe Generale (SCGLF) gained after the Financial Times reported that a merger could be in the works.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Monday — Apple's Worldwide Developers Conference

Tuesday — Business Roundtable CEO economic outlook

Wednesday — Commerce Department reports April's trade balance; Alphabet shareholder meeting

Thursday — JM Smucker (SJM) earnings