1. US tariffs confirmed: President Donald Trump has given his approval for the United States to put tariffs on $50 billion of Chinese exports, according to a source with knowledge of the situation.

An official announcement including a final list of impacted products is expected on Friday.

Beijing said it's ready to respond.

"If the United States takes unilateral protectionist measures and harms China's interests, we will respond immediately and take necessary measures to firmly safeguard our legitimate rights," Foreign Ministry spokesman Geng Shuang said Friday.

2. Euro slides: The euro has slumped 2.5% against the US dollar after the European Central Bank announced plans Thursday to end its €2.5 trillion ($2.9 trillion) stimulus program at the end of 2018.

The move helped push the dollar to its highest level this year against a basket of currencies.

The central bank said its plan was "subject to incoming data," and that interest rates would "remain at their present levels at least through the summer of 2019."

The end of money printing means the ECB thinks the economy no longer needs emergency support.

Meanwhile, there was worrying economic news out of Germany, where the Bundesbank cut this year's economic growth forecast to 2% from 2.5%. The central bank said that "uncertainties regarding the prospects for the German economy are considerably greater than they were."

3. Rolls-Royce upbeat: Shares in Rolls-Royce (RYCEF) spiked 13% after the UK engineering company said it expects free cash flow to exceed £1 billion ($1.3 billion) by 2020.

The announcement comes one day after the company said it would cut 4,600 jobs in an effort to slash costs by £400 million ($535 million) by 2020.

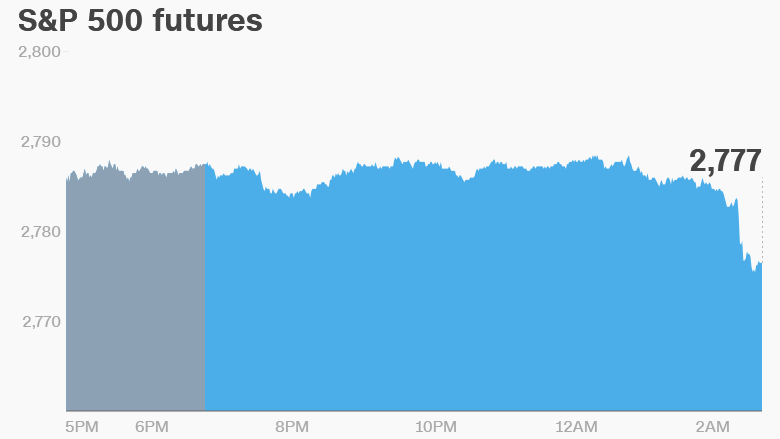

4. Global market overview: US stock futures were lower.

European markets were mixed, while stocks in Asia were mostly lower.

The Dow Jones industrial average closed 0.1% lower on Thursday. The S&P 500 added 0.3% and the Nasdaq gained 0.9%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Earnings and economics: Canada Goose (GOOS) will release earnings before the open.

The Bank of Japan left monetary policy unchanged at its meeting on Friday.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Friday — Deadline for White House to publish tariff list