1. China bears: China's benchmark Shanghai Composite has entered bear market territory, closing down more than 20% below its recent high in January.

The index fell 0.5% Tuesday.

Chinese stocks have come under pressure in recent weeks from concerns over the strength of the country's economic growth and an emerging trade war with the United States.

Potential restrictions on Chinese investments in the United States are the latest worry. US Treasury Secretary Steven Mnuchin tried to defuse concerns amid a market sell-off on Monday.

He tweeted that media reports on the investment restrictions were "false, fake news." He suggested that the measures would be "not specific to China, but to all countries that are trying to steal our technology."

2. GE sells another business: Walgreens (WBA) will officially replace General Electric (GE) on the Dow before the market opens, ending its 110 year membership.

GE, the Dow's worst performer last year, is trying to shrink itself and raise cash to pay down a mountain of debt. The conglomerate is under serious financial pressure following years of bad acquisitions.

On Monday, GE unveiled a $3.25 billion deal to sell its distributed power business, which makes gas engines that are used to generate electricity in remote places.

The sale, to the private equity firm Advent International, includes GE's Jenbacher and Waukesha brands as well as manufacturing plants in the United States, Canada and Austria.

3. More Brexit trouble: Investment in the UK car industry has halved because of Brexit uncertainty, according to the Society of Motor Manufacturers and Traders.

The industry group said that spending on new models, equipment and facilities in the United Kingdom was £347 million ($460 million) in the first half of the year, compared to £647 million ($860 million) in 2017.

SMMT said that Brexit could cause customs delays that would mean real trouble for the sector.

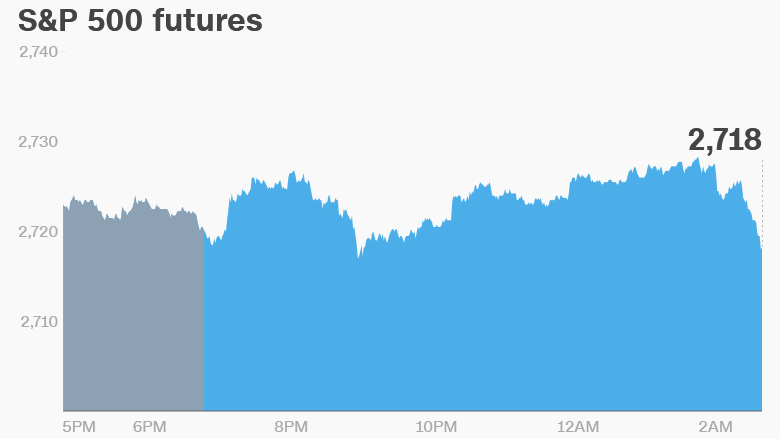

4. Global markets overview: US markets were poised for a rebound on Tuesday, with US stock futures pointing higher.

European markets opened higher, while stocks in Asia ended the session mixed.

The Dow slumped 1.3% on Monday, while the S&P 500 dipped 1.4%. The Nasdaq dropped 2.1%, its worst performance since early April.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Earnings and economics: Sonic (SONC) will release earnings after the close.

A US consumer confidence report for June will be released by the Conference Board at 10 a.m. ET. The index increased in May, after declines in April and March.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Tuesday — Walgreens (WBA) will officially replace General Electric (GE) on the Dow; US Consumer Confidence Index released for June;

Wednesday — Bed Bath & Beyond (BBBY), General Mills (GIS), Rite Aid (RAD) earnings

Thursday — Nike (NKE), Walgreens Boots Alliance earnings; Foxconn (TPE) breaks ground in Wisconsin; Stress test results

Friday — The White House plans to announce proposed restrictions on Chinese investments in the United States by Friday. They will take effect at a later date.