Search News

We're no longer maintaining this page.

For the latest business news and markets data, please visit CNN Business

Should the Supreme Court strike down the Defense of Marriage Act, which defines marriage as solely between a man and a woman, same-sex couples will see big changes to their finances -- for better and for worse.

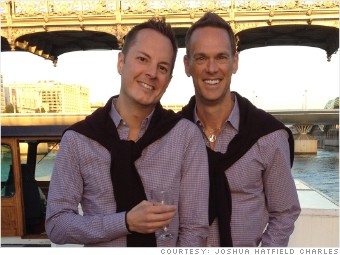

Joshua and Dixon wed in Connecticut almost four years ago, but they are still struggling to deal with their finances in married life.

"[We] have protections and privileges from the state, but on a federal level we are considered to be nothing more than legal strangers," said Joshua.

Each came into the marriage with properties and wanted to get both names on the titles for estate purposes. But they had to hire attorneys and accountants to avoid a huge 35% gift tax hit, since any transfer of value exceeding $13,000 to someone who is not your spouse in the eyes of the federal government is considered a gift under IRS rules.

So far, the legal expenses have been around $8,000. And, unless DOMA is overturned, they expect to pay another $7,000 to $9,000 in fees and taxes.

The couple would also save on the taxes they pay on the health benefits that Joshua receives through Dixon's insurance.

Their income tax bill is the only thing that wouldn't benefit if the Supreme Court decided to strike down DOMA. The couple currently balances deductions between the two of them in a way that lowers their overall tax liability.