Search News

We're no longer maintaining this page.

For the latest business news and markets data, please visit CNN Business

By selling their luxury homes before the end of 2012, these wealthy homeowners avoided two tax increases on Jan. 1 and a huge payout to the IRS.

Sales of luxury homes spiked in the final months of 2012, as high-end homeowners rushed to take advantage of lower tax rates before January 1.

Not only were these sellers concerned that fiscal cliff talks would lead to a hike in the capital gains rate but many were already facing a 3.8% Medicare surtax on investment income slated to go into effect in 2013 as part of the Affordable Care Act.

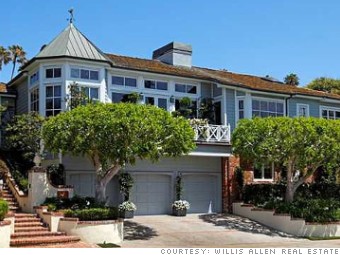

The sellers of this five-bedroom property decided to upgrade to a house on the beach one block away -- and they made sure to close the deal ahead of the January 1 tax law changes, said agent Drew Nelson of Willis Allen Real Estate.

By raking in about $3 million in profit in 2012 instead of 2013, they saved more than $110,000 on the 3.8% Medicare surtax on investment gains and another $150,000 or so on the hike in the capital gains rate to 20% from 15%.