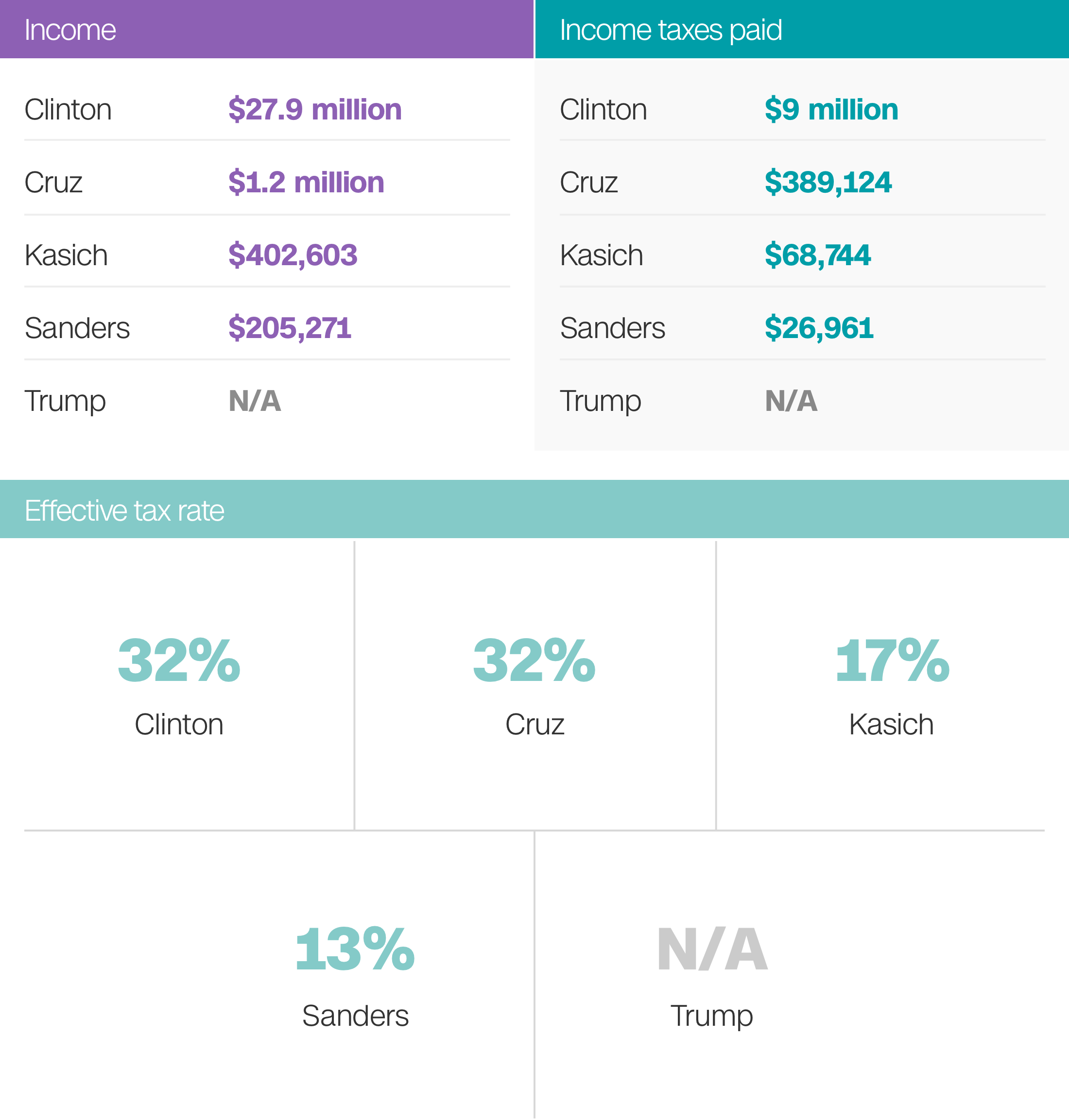

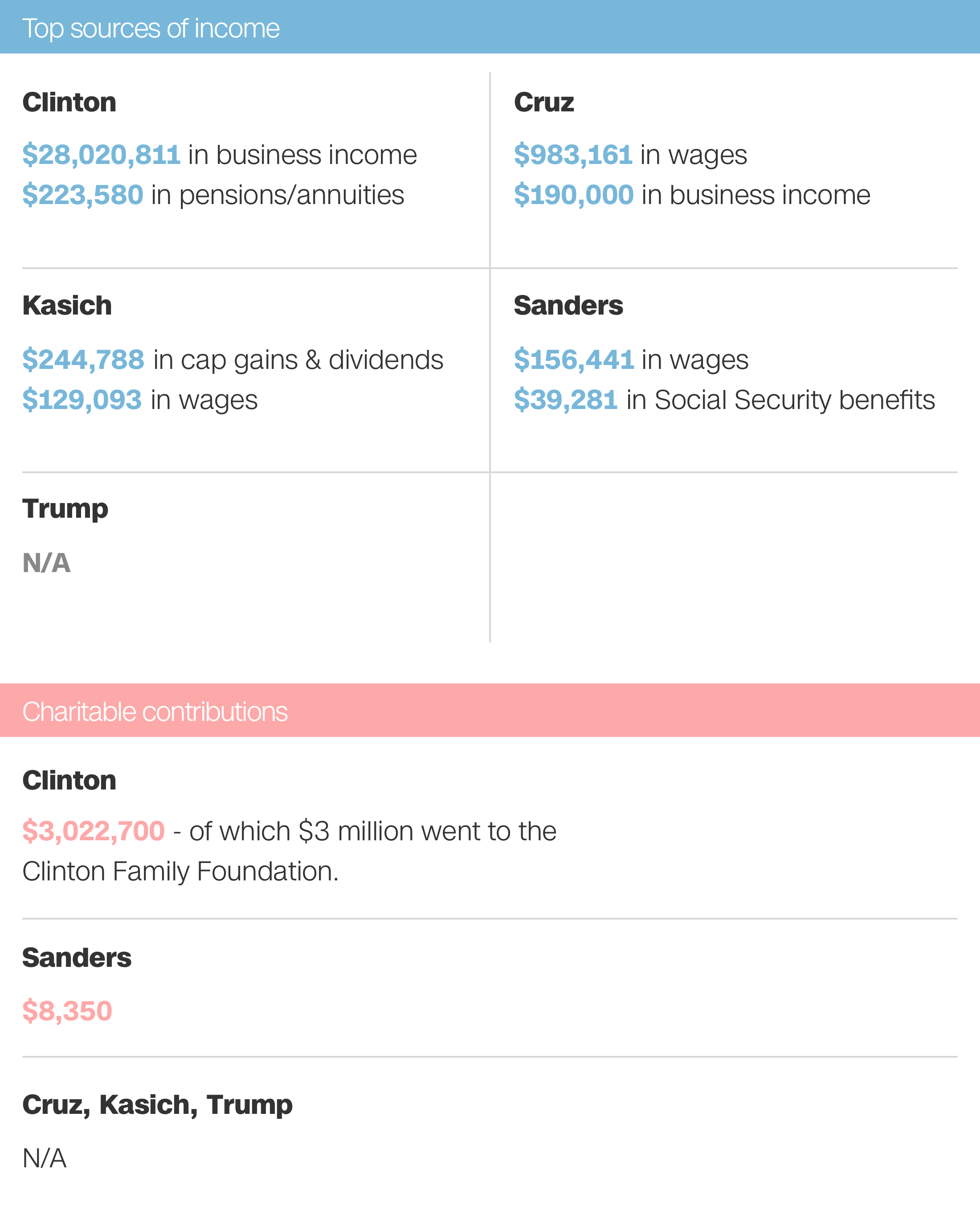

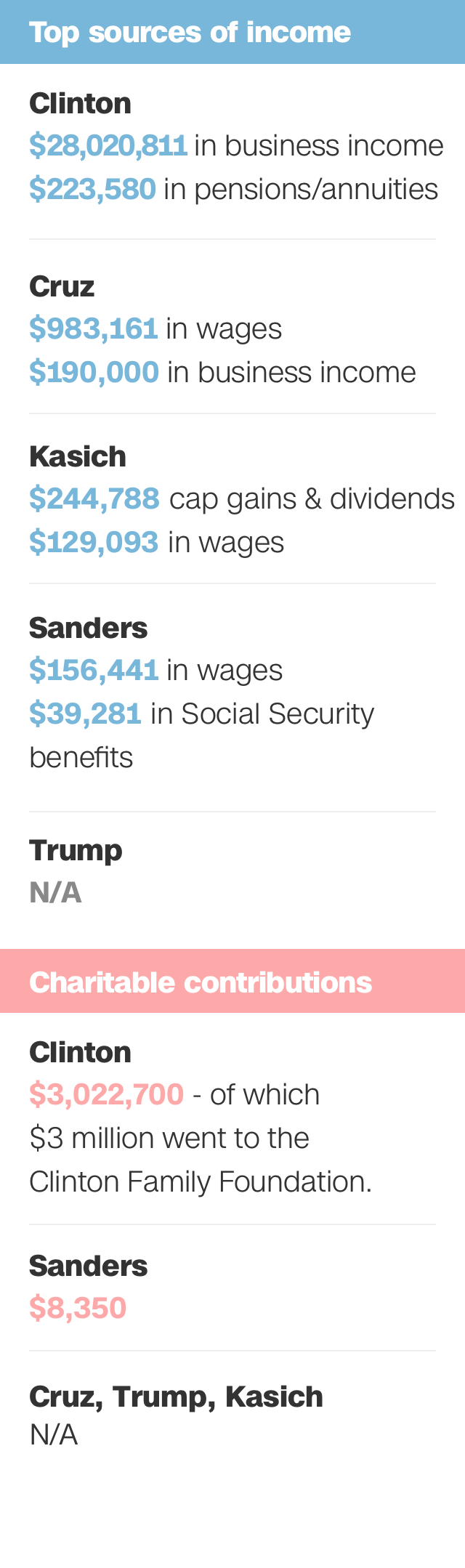

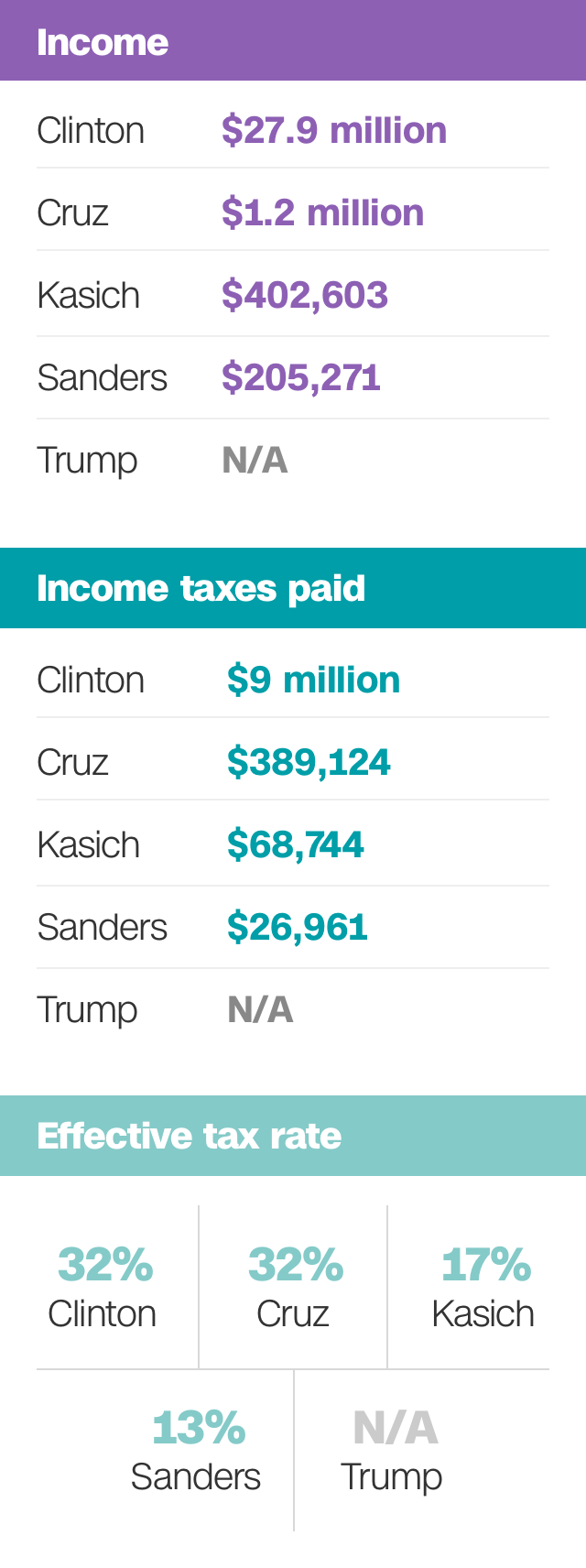

The candidates’ tax returns – what they made, what they paid

Here's a look at some key details from the 2014 federal tax returns of the remaining 2016 candidates.

Note: We’re still waiting on Trump's and all but Clinton declined to release full returns.

Published March 10, 2016; Updated April 20, 2016

*Note: Income reflects adjusted gross income. Taxes paid include federal income taxes, but exclude payroll taxes, household employment taxes and Medicare surtaxes. Effective tax rates measured as federal income taxes paid divided by AGI.

Election 2016: Taxes

-

Trump says he can't release tax returns because of audits - Bernie Sanders' mega tax increases largest in peacetime history

- Marco Rubio's tax plan would cost at least $6.8 trillion

- Here's how much Hillary Clinton's tax plan would hit the rich

- Ted Cruz would radically reform taxes but also explode the debt