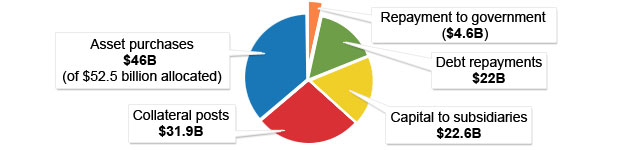

AIG: Where your money is going

The massive insurance company got $182 billion in bailout money. So far, it has laid out $118 billion – here's the breakdown.

|

ASSET PURCHASES $46 billion (of $52.5 billion allocated)

AIG sold insurance to banks worldwide to protect them against defaulting bonds. By buying up some of the assets in question, AIG is freed from some of those obligations.

|

|

COLLATERAL POSTS $31.9 billion

Due to a loss in value of the underlying assets, AIG has paid $22.4 billion to companies holding credit default swap insurance agreements and $9.5 billion to municipalities holding guaranteed investment agreements.

|

|

CAPITAL TO SUBSIDIARIES $22.6 billion

To adequately capitalize AIG’s subsidiaries in case of default, the insurer sent $20.9 billion in funds to life insurance units and $1.7 billion to its consumer finance divisions.

|

|

DEBT PAYMENTS $22 billion

The company spent $15.2 billion to pay down maturing debt at its troubled financial products division, and $6.8 billion to pay down other AIG debt.

|

|

REPAYMENT TO GOVERNMENT $4.6 billion

AIG has given $4.6 billion back to the government.

|

| Total $118 billion |

Sources: AIG, Federal Reserve