NEW YORK (CNN/Money) -

AT&T's losses widened during the fourth quarter, and the long-distance provider warned that continued business weakness would push first-quarter earnings below Wall Street forecasts.

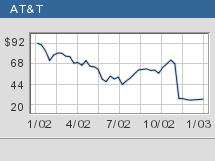

The news sent shares of AT&T (T: down $4.95 to $20.37, Research, Estimates) down as much as $5.82, or 23 percent, to $19.50 Thursday afternoon, helping push the Dow Jones industrial average toward a sixth straight loss.

AT&T said its loss from continuing operations widened to $611 million, or 79 cents a share, in the December quarter, compared with a loss of $216 million, or 31 cents a share, a year earlier.

Looking ahead, the nation's biggest long-distance telephone company warned that it does not see an improvement in demand soon and expects a first-quarter profit that will miss Wall Street forecasts.

The long-distance business has struggled amid increased competition from Baby Bells likes Verizon (VZ: down $0.66 to $36.33, Research, Estimates) and BellSouth (BLS: down $1.40 to $23.88, Research, Estimates). Many telecommunications companies face heavy debts from borrowing heavily during the '90s boom.

Including a gain of $1.71 a share from the sale of its cable operations, AT&T Broadband, to Comcast, AT&T earned net income of $516 million, or 66 cents a share, in the quarter. Analysts surveyed by earnings tracker First Call expected a profit of 71 cents a share from AT&T.

The company said it does not yet see a significant turnaround in the overall business services industry, and it expects earnings per share between 50 and 55 cents in the first quarter. Analysts surveyed by First Call have a consensus EPS forecast of 69 cents for the current quarter.

"We're in the midst of a very difficult time in the telecom industry. Demand has been very week, particularly among the telecom-intensive sectors such as travel and financial services," said AT&T Chief Financial Officer Tom Horton on CNN Money Morning. "We think 2003 will be another tough year in the telecom industry."

Revenue at the company fell 8.6 percent to $9.3 billion in the December quarter, slightly better than the First Call forecast of $9.2 billion.

AT&T also said it would no longer forecast quarterly and annual earnings, joining a growing list of major companies not offering such guidance, including McDonald's Corp. (MCD: down $0.39 to $14.97, Research, Estimates) and Coca-Cola Co (KO: down $0.46 to $44.09, Research, Estimates).

AT&T shares had performed reasonably well since the company in November became the first Dow stock to execute a reverse stock split.

"Despite the sharp selloff at this morning's open, we would still look for a lower entry point," J.P. Morgan Securities analyst Marc Crossman told clients Thursday.

Crossman cut his rating on AT&T to "neutral" from "overweight" while taking down his 2003 earnings estimate to $1.88 a share from $3 a share.

Without its cable assets, AT&T is now closer to the pure phone company that it was in 1984 before regulators split the then-monopoly.

-- Reuters contributed to this report

|