NEW YORK (CNN/Money) -

American International Group CEO Maurice "Hank" Greenberg Tuesday came one step closer to retiring from the insurance company he has led since 1967, saying that the third CEO in AIG's 84-year history has been chosen.

But Greenberg, 77, declined to name the individual, or say when that person would take over, meaning the long-standing question of CEO succession at AIG could continue for years.

|

|

| Maurice Greenberg |

"My successor is in the company," Greenberg said in response to a question during a financial services conference in New York. "The board knows who he is, and the individual knows who he is."

The succession issue has for years dogged AIG, the biggest insurer by market capitalization. Greenberg, who has shepherded the company through a dramatic three-decade expansion, has been reluctant to retire from the firm he joined in 1960.

"They are working on a clone for me right now," Greenberg said to laughter from the audience at Salomon Smith Barney's Financial Services Conference.

His successor faces a tough time building on the Greenberg legacy. A $1,000 investment in AIG stock in June 1969, when the company went public, would be worth $192,100 today.

"He's done an exemplary job," said Ira Zuckerman, who covers the company for Nutmeg Securities Ltd. "If he hadn't been doing the job, he wouldn't be there."

The company's 2002 results, due next month, should cap a seventh straight year of earnings gains. When AIG reports fourth-quarter profits Feb. 13, analysts expect earnings of 91 cents a share, according to First Call, which tracks forecasts, up from 71 cents in the year-ago quarter.

Tse or Sullivan?

Tuesday's announcement adds little clarity to the succession question. Greenberg last summer appointed AIG veterans Martin Sullivan and Edmund Tse as co-chief operating officers, with the idea that one would become CEO.

He also named Frank Zarb, an AIG board member who once ran the National Association of Securities Dealers, as chairman of the board's executive committee. Sullivan is in his late 40s. Tse is in his mid-60s.

Like Jack Welch, the former CEO of General Electric, or Warren Buffett, the CEO of Berkshire Hathaway, Greenberg's identity is inseparable from AIG's.

But GE spent considerable time publicly preparing for Jeffrey Immelt's anointing as CEO, a process that is apparently going on privately at AIG.

One of Greenberg's sons, Evan, was groomed for the job, but left to become CEO of another insurer, ACE Tempest Re, in 2002.

Abrupt leadership changes can jar investors. Shares of Broadcom (BRCM: Research, Estimates), a chip maker, tumbled 14 percent Friday after CEO Henry Nicholas surprised investors by saying he would leave the company.

"Will anyone be able to replace Hank Greenberg?" asked J. Jeffrey Hopson, who follows the company for A.G. Edwards. "That remains to be seen."

Asian roots

Cornelius Starr founded AIG in Shanghai, China, in 1919. New York-based AIG now underwrites insurance policies in 130 countries. But its Asian roots remain important to Greenberg, who is a trustee of the Asia Society and founding chairman of the U.S.-Philippine Business Committee.

"I believe that one day our business in China will dwarf all of the other components we have," Greenberg told conference attendees Tuesday.

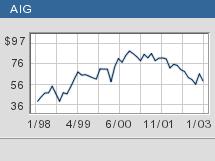

Shares of AIG (AIG: Research, Estimates) have doubled during the last six years. But the shares, which are off 28 percent from their 52-week high of $78, have proven vulnerable of late.

They tumbled 8 percent Friday after Morgan Stanley downgraded the stock and said the property and casualty business will have a tough time raising prices amid an uncertain economy. AIG shares rose 78 cents to $56 Tuesday, lifting its market value to $144 billion.

Regardless of when he retires, Greenberg has already defied the odds. A recent study on CEO tenure found that in 2001 the mean age of outgoing CEOs was 57 and the average tenure was 7.3 years.

"CEOs of the world's largest companies are serving for less time and are younger when they step down," the authors of the study from the consulting firm Booz Allen Hamilton wrote.

Another study, this one from Drake Beam Morin, found that nearly eight of the top ten companies worldwide changed their top leader at least once during the 1990s.

Greenberg, who declined to be interviewed for this article, has numerous outside interests, particularly in art and health care.

He is chairman emeritus at New York Presbyterian Hospital , a trustee of the Museum of Natural History, a lifetime trustee at New York University, and an honorary trustee of the Museum of Modern Art.

Greenberg served in the Army in Europe during World War II and rose to the rank of captain by the Korean War. A lawyer, he was admitted to the New York bar in 1953.

A member of the Business Roundtable, Greenberg has chaired the New York Federal Reserve Bank and has been a director at the New York Stock Exchange. He is married and has four children.

Stunning run

Adjusting for 14 stock splits, shares of AIG are up 19,210 percent since the company went public in June 1969. That's well ahead of the Standard & Poor's 500 index, which rose 735 percent during those 34 years.

AIG under Greenberg grew by acquisition. The company snapped up HSB Group, American General Bank, SunAmerica and New Hampshire Insurance, among others. AIG has also expanded globally, becoming, in 1979, the first Western insurer to venture into Hungary, Poland and Romania.

Greenberg's 77 years, though often talked about, do not appear to be a liability. The CEO of AIG, after all, is just slightly older than Federal Reserve Chairman Alan Greenspan, who turns 77 in March and is conducting a two-day policy setting meeting in Washington this week.

"I think he's in better shape than most of us," one pension fund analyst said of Greenberg.

But that hasn't kept Greenberg from preparing, if only vaguely, for life outside AIG.

"Things will go on just as they have," he said Tuesday.

|