NEW YORK (CNN/Money) -

Rock group Nirvana's 1991 angry counter-culture anthem "Smells like Teen Spirit" is right on the money to describe a group that looks red hot for retailers -- the nation's teenagers.

Enough said about who wasn't buying what over last holiday season, kids aged 10 through 18 shelled out $170 billion last year on clothes, music, electronic gear and other crucial-for-teens items in the United States -- a trend that has sparked hot growth for specialty chains including Hot Topic and Pacific Sunwear.

"Teens for the most part get an allowance, don't pay rent, mortgage, or insurance costs, and also don't pay for their food" so they tend to spend more freely than their parents at the mall, said Kurt Barnard, a retail industry consultant. They also boost their incomes through baby-sitting, lawn mowing and other odd jobs, he noted.

According to tracking firm Teenage Research Unlimited (TRU), teens spent about $170 billion last year, down slightly from $172 billion the year before, but still healthy given a tough climate for retailers nationwide. About $70 billion, or 40 percent of that, went to clothing, according to TRU.

As a result, the chains that cater to teens have posted strong sales and profits compared to their adult counterparts, and industry analysts have taken notice.

"Investors should be excited about teen apparel stocks because most of the merchants in that space are competing for a huge $70 billion pie," said Brian Tunick, retail analyst with J.P. Morgan. "Whereas the overall retail apparel space is suffering from overcapacity and increasing competition, the teen space is really a niche segment of that pie and has a lot more room to grow."

Some hot and trendy stocks

Even though 2001 offered few must-have items, whether in clothing, accessories or electronics goods, preteens and their older siblings still managed to find plenty of stuff to buy. "Teenagers are likely to spend money regardless of the trend," said Rob Callender. "If there is no trend, they just spend on a more diverse set of products."

Other beneficiaries of the teen spending boom? Abercrombie & Fitch, Aeropostale, Charlotte Russe, and Urban Outfitters (URBN: Research, Estimates).

Hot Topic (HOTT: Research, Estimates), with 437 stores across the country blasting music at teens as they shop, saw its sales jump 10.6 percent in December at stores open at least a year, far outstripping the results at many specialty chains. The California-based retailer recently raised its fourth-quarter earnings forecast to about 47 or 48 cents a share, up from 38 cents a share a year earlier, and above Wall Street's then-current forecasts of 46 cents a share.

Pacific Sunwear (PSUN: Research, Estimates), another music-inspired teen apparel retailer upped its fourth-quarter estimate to 43 cents a share from 37 cents a share, roughly a 48 percent increase in earnings over the same quarter a year ago. The chain, also based in California, saw December "same-store" sales jump 16.1 percent.

"These two companies have been lighting it up," said Ken Perkins, retail analyst with First Call. "They had a super December and they've generally been showing decent sales and earnings growth compared to other names in the specialty retail sector."

By contrast, Ann Taylor (ANN: Research, Estimates), logged December same-store sales that tumbled 14.6 percent in December, while the Gap (GPS: Research, Estimates) showed a 5 percent increase in December store sales.

Analysts flagged Hot Topic and Pacific Sunwear as the two chains best positioned to outperform the niche sector in 2003 because both companies are nimble when catering to the finicky tastes of teen shoppers.

How do Hot Topic, Pacific Sunwear and Charlotte Russe (CHIC: up $0.18 to $10.48, Research, Estimates), another chain, do it? They buy domestically, meaning they can get products faster and tap into fashion trends more quickly than competitors; speed that's key to being successful in this sector, industry analysts said.

"Hot Topic and Pacific Sunwear are doing extremely well because of their differentiated products," said Dana Telsey, specialty retail analyst with Bear Stearns, noting Hot Topic's 33 "Torrid" concept stores also have done well, offering more in the way of alternative teen fashions, like the punk , rock or gothic looks for large-sized teenagers who want "funky" clothes.

Another allure of the Torrid concept stores is the way the merchandise is arranged thematically, which makes it easier and faster for shoppers to find the look that they want.

"We set up our clothes in sections based on music genres, like punk or rock,"said Sylvia Niles, buyer for Torrid apparel. "Also, all our clothes hang facing the customers as they walk in. Our clothes don't hang sideways on racks because every item has a novelty factor and we want to emphasize that to the maximum."

By contrast, Abercrombie & Fitch, Limited (LTD: down $0.20 to $12.35, Research, Estimates), American Eagle Outfitters (AEOS: Research, Estimates) and Aeropostale (ARO: Research, Estimates) -- other chains that also cater to teen customers -- design their own branded products six to nine months ahead of the season and import much of that from China and elsewhere in Asia. While that helps control costs, styles and trends may have changed by the time their clothing hits the racks.

Same-store sales at Abercrombie & Fitch (ANF: Research, Estimates), famous for its catalogs featuring scantily clad models, were flat in December.

Earnings tracker First Call estimates 22 percent earnings growth and 24 percent revenue growth for the fiscal year ending in January 2004 for Hot Topic and 19 percent earnings growth and 12 percent revenue growth for Pacific Sunwear.

The success of the specialty teen apparel merchants, which together account for only 13 percent of the $70 billion market, also has the big guns like discount chains Wal-Mart (WMT: Research, Estimates) and Target (TGT: Research, Estimates) upping the ante in the teen product portfolio.

Wal-Mart, which gets about 100 million customers a week at its stores, last year debuted the much-touted Mary-Kate and Ashley Olsen brands of tween apparel for 8 to 12 year olds. Wal-Mart spokesman Tom Williams declined to comment on the competition from the smaller teen specialty chains, saying only that its strategy for teen and tweens was the same as for adult customers -- low prices.

"Teenagers are a very important market for us and we think it's going to grow," said Carolyn Brookter, spokeswoman for Target. "We're focusing on making our products for teens and tweens more attractive at good prices so that when they walk into a Target store, it's a cool experience for them."

Caution: Fashion is fickle

Industry consultant Barnard said he's confident teen spending will carry on through 2003 without suffering a major slowdown. But some other analysts are more cautious. Even those who are bullish on retail stocks note consumer spending is vulnerable to the twists and turns in the broader economy.

Tunick of J.P. Morgan said while teen retailers as a whole have $1.5 billion in cash, little debt and thus are not at high risk for bankruptcy even if business softens, the business remains extremely competitive on price, which makes growing profits more difficult. In fact, he's predicting fourth-quarter earnings for the teen retailers as a group will actually fall 6.3 percent from a year-earlier.

"On the economic front, deflation is hurting companies," said Tunick. "Mall traffic across the U.S. is down for the last 21 months, there's a lack of fashion newness out there. The average price that teens are paying for an item is down, and it's difficult to see profit pick up in 2003."

Nevertheless, Tunick is upbeat on Hot Topic, Pacific Sunwear and Abercrombie & Fitch, and has an "overweight" rating on all three stocks. Both Hot Topic and Pacific Sunwear have had a strong year so far, and have managed to buck the deflationary pressures hurting some other retailers, he said. J.P. Morgan has an investment banking relationship with Hot Topic, Aeropostale and Pacific Sunwear.

Hot Topic currently trades at 20 times estimates of the fiscal year ending January 2004, while Pacific Sunwear's P/E is 16. "When you compare that to the industry multiple of 13.5, these stocks look a little overpriced but they are in good shape," Tunick added.

Meanwhile, the chains are getting ready for spring, with some analysts saying the season's fashions bode well for Hot Topic and Pacific Sunwear.

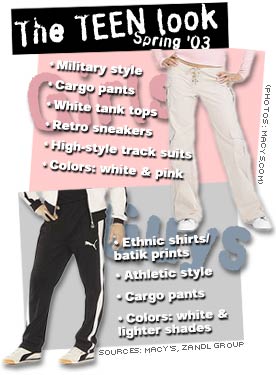

While Wall Street continues to worry about a likely war in Iraq -- Secretary of State Colin Powell was making his case to the U.N. Wednesday -- the ongoing debate appears to have inspired what could be a hot look for teens this spring -- "military-style" fashions, including cargo pants and army surplus gear.

|