NEW YORK (CNN/Money) -

Intel narrowed its first-quarter revenue guidance Thursday. But its most optimistic expectations are below what it predicted earlier this year.

The world's largest maker of semiconductors also lowered its guidance on gross margins, a key measure of profitability for the company. Shares tumbled more than 3 percent Friday morning as a result, following a 1.6 percent slide Thursday.

The Santa Clara, Calif.-based company said it expects sales to come in between $6.6 billion and $6.8 billion. In January, Intel told Wall Street that it was expecting revenue to come in between $6.5 billion and $7 billion. According to First Call, the consensus estimate of Wall Street analysts is $6.8 billion, unchanged from the same quarter a year ago.

The company did not give guidance on earnings. Analysts are expecting earnings per share of 12 cents, compared with 15 cents a share in the first quarter of 2002. John Rutledge, manager of the Evergreen Technology fund, says that based on the sales and gross margins guidance Intel gave, it should still be able to hit this target, but that it is no longer a sure thing. Rutledge does not own shares of Intel.

However, an analyst at CSFB cut Intel's full year 2003 estimates on Friday and trimmed 2004 estimates as well. A Merrill Lynch analyst also cut 2004 estimates. For more about analyst estimate changes, click here.

Intel usually is conservative

The lowered sales outlook was a bit of a surprise to those who follow the company. "Intel has a history of undershooting in its initial guidance," said Ted Parrish, co-manager of the Henssler Equity fund, which owns Intel shares.

For example, Intel reported $7.2 billion in sales during the fourth quarter, well ahead of the guidance of $6.8 billion to $7 billion it gave Wall Street during a mid-quarter update in December. And even that guidance was higher than Intel's first projections of $6.5 billion to $6.9 billion for the quarter.

Parrish said the gross margin news was mildly disappointing as well. Intel said gross margins, which measures how much profit a company is wringing from sales before operating expenses, would probably be slightly below 50 percent. The company told Wall Street back in January that it was expecting gross margins of 50 percent, and Parrish said he was hoping that Intel would raise the target to 51 percent.

Intel said sales in its main business of selling chips to PC manufacturers was slightly better than expected but that the company was seeing lower-than-expected sales of flash memory chips in its communications division. Intel is trying to diversify beyond its traditional PC business into areas like cell phones but by doing so it is coming up against tough competition from companies like Texas Instruments (TXN: Research, Estimates).

During a conference call Thursday evening, Intel CFO Andy Bryant said revenues and gross margins would have been higher if not for the shortfall in flash memory sales. Bryant added that the reason for this shortfall was weaker-than-expected demand for higher-priced cell phones and personal digital assistants (PDAs), which require lots more flash memory.

But Bryant stressed that Intel remains committed to the communications business and that eventual upgrades to higher-end devices by consumers will benefit Intel in the long run.

Recovery hopes fading?

To that end, a focus on wireless products is expected to be a key area for Intel going forward. Intel is formally unveiling Centrino, a new line of processors, on March 12. These chips will be components of new laptops specifically designed for wireless networking, i.e., connecting to the Internet without the computer being tethered to a phone line or cable.

How well Centrino does will be widely watched on Wall Street since the traditional desktop market -- long Intel's bread and butter -- continues to mature. "Mobility is the area where we expect to see better growth prospects," says Mark Schultz, portfolio manager with M&T Asset Management, which runs the Vision group of funds. Intel is a holding in the Vision Large Cap Core fund.

| Related stories

|

|

|

|

|

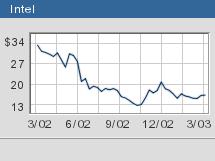

But the company only briefly mentioned Centrino during the call. So the lowered guidance remained the focus for investors. Hopes for a semiconductor recovery have been increasing as of late. Shares of Intel (INTC: Research, Estimates) have gained nearly 7.5 percent this year and are up more than 25 percent from their early October lows. Two prominent Wall Street analysts also recently upgraded their views on Intel and other chip companies.

And conventional wisdom is that semiconductor companies usually lead technology recoveries since chips are the building blocks of most devices. So it was not surprising to see Intel's poorly received news having a ripple effect on other chip companies and the entire tech sector on Friday.

Shares of Texas Instruments and fellow chip makers Xilinx (XLNX: Research, Estimates) and Maxim Integrated Products (MXIM: Research, Estimates) were down about 1 percent on Friday morning. Shares of semiconductor equipment companies Applied Materials (AMAT: Research, Estimates), Novellus Systems (NVLS: Research, Estimates) and KLA-Tencor (KLAC: Research, Estimates) slipped on Friday morning as well. These companies all count Intel as a major customer.

"For the first couple of months of the year, tech stocks were trading more on hope than anything else," said Evergreen's Rutledge. "But as the year progresses, it is starting to appear that the hope was not justified."

|