NEW YORK (CNN/Money) -

Airlines dealing with a sharp drop in air traffic in the wake of the war with Iraq are looking for billions of dollars worth of additional federal assistance to keep flying through the latest downturn.

But analysts and some of the industry officials pressing for aid say that any assistance, even coupled with the recent decline in jet fuel prices, might not be enough to keep major carriers from seeking bankruptcy protection -- or even keep some already bankrupt carriers from halting operations altogether.

President Bush's $75 billion estimate for the cost of war Monday did not include figures for airline industry assistance.

The start of the war has already produced a new bankruptcy filing, by Hawaiian Airlines (HA: Research, Estimates), which filed for Chapter 11 protection Friday. Analysts believe that further bankruptcy filings will follow.

Blaylock & Partners airline analyst Ray Neidl said investors should be selling airline stocks on any rise they see due to optimism about the war efforts.

"Once the war is over, the big network carriers still have a problem -- their cost structure is still too high," he said.

Neidl said United Airlines, the world's No. 2 carrier, has only about a 25 percent chance of successfully emerging from the bankruptcy filing of last December with its cost structure in balance. He says he believes there's a 15 percent chance of liquidation and a 60 percent chance of slow death for the carrier.

Neidl also believes the chance of a bankruptcy filing for industry leader AMR Corp. (AMR: down $0.30 to $2.08, Research, Estimates), parent of American Airlines, has risen to somewhat better than 50-50 due to the impact of the war. He said a sharp drop in jet fuel prices over the last couple of weeks isn't enough to help keep AMR or other teetering carriers out of bankruptcy, even though fuel represents their second largest cost after labor.

"There's no one factor that will save any of them," he said.

Uphill battle for more aid

The first Gulf War produced a rash of bankruptcy filings and liquidations in the months following the conflict. The federal assistance seen as most likely to win support this time could be the federal government picking up some of the post-Sept. 11 security cost increases, which the Airline Transport Association, the industry trade group, puts at about $4 billion to $5 billion a year.

|

| |

|

|

|

|

Airline credit analyst Philip Baggaley discusses the industry's prospects for recovery. Airline credit analyst Philip Baggaley discusses the industry's prospects for recovery.

|

|

Play video

(QuickTime, Real or Windows Media)

|

|

|

|

|

"This is more about long-term survival than immediate assistance," said an industry executive who is familiar with efforts to win support for a new aid package. "The relief will not necessarily be 'I'll write you a check right now' -- it's about reducing future costs. It's not going to take the form of 9/11 assistance (when the industry received $5 billion in direct grants)."

But even the industry executive reports that the battle for help this time is an uphill battle, both within the Bush administration and on Capitol Hill. He said that Vice President Dick Cheney's office wants to limit the supplemental spending bill expected from the administration later this week to military expenditures and foreign aid to Middle East allies, while the airlines' supporters are seeking to attach the ATA's request for help with security costs to that measure.

"I know there are members of both parties in Congress interested in doing something. Then again there's certainly opposition from both sides," he said.

Jet fuel prices dropping

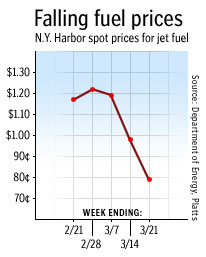

Jet fuel prices have dropped sharply in the last month, to 80 cents a gallon on the New York spot fuel market at the end of last week from $1.2775 a gallon on March 3 and just under $1 a gallon on March 14 . Prices were up a few cents a gallon in Monday trading, said John Kingston, global director of oil for energy trader Platt's, with the weekend's war news dampening last week's hopes of a quick end to the war.

But Kingston said factors other than the end of the war, including the end of the home heating oil season, are also helping to reduce prices. "Right now all the market is doing is riding up and down on war news, but don't overlook the fact that winter is over," he said.

A sharp drop in jet fuel prices following the Sept. 11 attack, due to a mild winter and reduced global economic activity, helped the airlines ride out the problems encountered in the months following the attack, although almost all major carriers saw losses widen. The fuel price decline this time should also help, said an industry executive, but not enough given prices are only falling from high levels.

"There's no question that lower is better," said the executive. "Whether it's enough is another question."

United may halt operations

United Airlines parent UAL Corp. (UAL: Research, Estimates) warned in a recent bankruptcy court filing that halting operations is a "distinct possibility," due to the drop in demand for flying accompanying the war, if it doesn't get new labor cost concessions. Airline spokesman Joe Hopkins said the carrier is hoping Congress will agree to new federal assistance, but that help is not yet part of its business recovery plan.

Hopkins said United's international bookings are down about 40 percent compared with a year ago due to the war, and that domestic bookings are also off a "significant" amount. He said the carrier should still have the liquidity to get through the end of April, even if fighting continues to depress air travel.

But Hopkins added that if the airline hasn't won new labor agreements either from its unions or from the bankruptcy court by the end of April, it could be in violation of its loan agreements from lenders providing bankruptcy financing.

"April will be a very important month for us," said Hopkins. In case the war continues to hurt performance throughout April, Hopkins said the airline is negotiating with the lenders, seeking more time due to the impact of the war.

Don Carty, CEO of American Airlines parent AMR Corp., said last week that his company may make cuts deeper than the 6 percent reduction in international flights announced last week.

"How much, from where, and for how long will become clearer as we learn more about customer reaction to and the duration of the conflict in the Middle East," said Carty in a message to employees.

Click here for a look at airline stocks

He also assured employees "we'll continue working to avoid bankruptcy," but he admitted that the combination of the drop in demand due to the war coupled with current economic problems make the outlook uncertain.

"This conflict could not come at a worse time," Carty said. "To now lose passengers that we've all worked so hard to get back on our airplanes would prove very disheartening."

Reuters contributed to this report

|