NEW YORK (CNN/Money) -

Rebuilding Iraq, especially its rich oil fields, will be a multibillion-dollar job, and much of the early work will be done by U.S. companies.

Key to the rebuilding -- which could cost anywhere from $10 billion to $200 billion, according to the wide range of analysts' estimates -- will be oil, Iraq's life blood.

Funds from oil exports are used to buy food, clothing and medicine for about 60 percent of all Iraqis, and officials in the Bush administration hope it will also be enough to pay the cost of rebuilding Iraq's roads, bridges, hospitals, power grid and other critical infrastructure.

But Iraq's oil fields have seriously degenerated since the years of its devastating 1980-88 war with Iran, due mainly to a lack of modern equipment, industry experts say. Extracting enough oil to rebuild the country -- or even to keep Iraqis from starving -- will take a lot of prep work.

"After two major wars and a decade of sanctions, Iraq's oil industry is in desperate need of repair and investment," said a recent study by the James A. Baker III Institute for Public Policy at Rice University, named for the first President Bush's secretary of state during the first Gulf War.

Who cuts up the pie?

The Kellogg Brown & Root unit of Halliburton Co. has already won a contract from the government to make emergency repairs to Iraq's oil fields and get them to pre-war production levels of about 2 million barrels per day (bpd), and President Bush has asked Congress to earmark $489 million for the job.

Halliburton's contract was designed to last two years and be worth up to $7 billion; but the Army Corps of Engineers, the contract's issuer, has said that duration and amount were only for the worst-case scenario, if Saddam Hussein had done serious damage to Iraq's oil infrastructure.

Since very little damage has been done to Iraqi oil fields -- Halliburton's only been given about $50 million in repair orders so far -- the Army says it hopes soon to replace Halliburton's contract with a permanent contract, awarded after competitive bidding, to do long-term work on the oil infrastructure.

The big job of getting Iraq's fields back to their pre-1991 production of about 3.5 million bpd will take at least 18 months and cost about $5 billion initially, and $3 billion more in annual operating expenses, according to the Baker Institute study.

If the U.S. government is handing out the contracts for this job, the biggest beneficiaries, according to Banc of America Securities energy analyst Jim Wicklund, would be Dallas-based Halliburton (HAL: Research, Estimates), Baker Hughes Inc. (BHI: Research, Estimates), Weatherford International Inc. (WFT: Research, Estimates) and Schlumberger Ltd. (SLB: Research, Estimates) -- in that order. All of them are oil field service companies with the expertise to rebuild Iraq's fields.

But the U.S. government might not have the authority to give those contracts out. Instead, the United Nations, which runs the program under which Iraqi oil is sold for food and humanitarian supplies for the Iraqi people, could get the authority to take bids and might look beyond the United States for bidders.

Yet that also could spark a political backlash in the United States. Imagine how the "freedom fries" set would react if the rebuilding job goes to a French oil company such as TotalFinaElf S.A. (TOT: Research, Estimates)

| Related stories

|

|

|

|

|

For now, though, this political hot potato is still up in the air. The U.N. says it needs a Security Council resolution to start soliciting bids for rebuilding Iraq, and the sharply divided Security Council may not approve one.

Meanwhile, the State Department's U.S. Agency for International Development (USAID), which is handling much of Iraq's reconstruction, already has solicited bids for eight contracts for a variety of tasks, such as repairing roads, bridges, hospitals, water and sanitation systems, and more.

Oil field repair was not on the list, and the agency would not speculate about whether it will be in the future.

"This is by no means an inclusive list, but how far beyond that we're going to go, I'm not sure yet," USAID spokesman Luke Zahner said.

The pipe dream: Iraq astride the oil industry

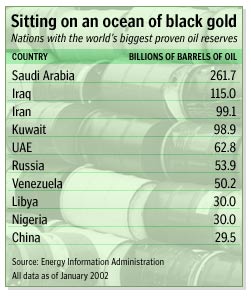

Halliburton and other oil field services companies also could win big from another, pipe-dream scenario that involves beefing up Iraq's capacity to fully exploit its vast reserves of oil underground, which total at least 110 billion barrels, the second-largest proven reserve in the world.

"With the right investment environment and under the right government, Iraq could increase production by a million barrels a day every year for the next 10 years," said Fadel Gheit, oil analyst at Fahnestock & Co. "It could be the largest oil exporter in the world, eclipsing Saudi Arabia."

That investment, Gheit said, could be $10 billion a year for the next 10 years. While that sounds like a bonanza for companies like Halliburton and other oil-field services firms, industry analysts warn that exploration in Iraq could merely shift resources from other parts of the world.

In other words, Halliburton will be building oil wells one way or the other, and tapping Iraq's ocean of oil won't do much for its revenue growth.

"If I'm Exxon Mobil (XOM: Research, Estimates) and I have a budget and Iraq opens up, I'm not going to increase spending -- I'm just going to rearrange my priorities," Gheit said. "I might like all the dishes on the table, but I only have one stomach, so I'm not going to eat all of them."

Smaller jobs

For a time, Halliburton was reported to be in the running for the biggest current USAID contract, worth up to $600 million, to rebuild Iraq's infrastructure after the war. Though Halliburton has denied putting in a lone bid for the job, news reports said it had bid jointly with another company.

But other news reports suggested Halliburton might have backed out of the running because of the controversy surrounding its Army contract to fix Iraq's oil infrastructure. Democratic congressmen complained that Halliburton, of which Vice President Dick Cheney was CEO from 1995 to 2000, got the Army contract without a competitive bid process.

Halliburton has said it remains a potential subcontractor for the job.

Two other public companies, Washington Group International Inc. (WGII: Research, Estimates) and Fluor Corp. (FLR: Research, Estimates), were also once reported to be in the running for the USAID contract, but apparently their bids were either withdrawn or were unsatisfactory.

However, those companies, along with Framingham, Mass.-based Perini Corp. (PCR: Research, Estimates), each won Army contracts, worth up to $100 million each, to do general contracting work in the Army Central Command's area of operations, which includes Iraq and Afghanistan. Though no specific work has been assigned to those companies yet, they could end up working in Iraq.

"We haven't been given any assignments yet, but we can project our presence anywhere within 24 hours," said Perini President Robert Band. "We're ready to go to work anywhere."

Still in the running for the main USAID contract, according to several news reports, are private companies Bechtel Group Inc. and Parsons Corp.

Other private companies, including International Resources Group, Stevedoring Services of America, Creative Associates International Inc. and Research Triangle Institute, have won smaller contracts for jobs such as clearing ports, rebuilding educational systems and organizing local governance.

More work, billions of dollars' worth, will be needed after these preliminary jobs are awarded. But those bids might not be taken until a new Iraqi government is in place.

|