NEW YORK (CNN/Money) -

Microsoft Corp. said Tuesday that earnings per share unexpectedly rose in the latest quarter, as the No. 1 software maker weathered a slump in corporate spending on new technology.

But Microsoft's outlook was mixed. The company, whose fortunes are tied to the lackluster personal computer market, said profits for the remainder of its fiscal year would top analysts' forecasts while current-quarter sales could fall short.

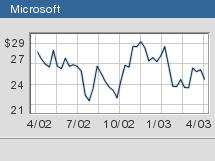

Still, Microsoft shares jumped $1.14, or 4.6 percent, to $25.75 in after-hours trading Tuesday after slipping during the regular session as investors focused on the upside profit surprise.

"This tells you how strong the company is," said Sunil Reddy, portfolio manager at Fifth Third Bancorp, which owns Microsoft shares. "You see that Microsoft is holding its own, even in this tough environment."

Microsoft reported a fiscal third-quarter profit of 26 cents a share, or $2.79 billion, up from earnings per share of 25 cents, or $2.74 billion, in the year-ago quarter. Revenue rose 8 percent, to $7.84 billion in the March quarter from $7.25 billion for the same period a year ago, Microsoft said

Analysts expected Microsoft (MSFT: Research, Estimates) to earn 24 cents a share on $7.7 billion in revenue, according to First Call, which tracks Wall Street forecasts.

Looking ahead, the company said profit in the current fiscal year ending in June should come in between $1.04 and $1.06 per share on revenue of $33.1 billion to $33.8 billion. While that would top analysts' forecasts for a profit of $1.02 a share on $32 billion in revenue, Microsoft forecast that current-quarter sales would fall below the $8 billion that analysts were expecting.

"The guidance is a little disappointing," said Brendan Barnicle, who follows the software maker for Pacific Crest Securities.

Microsoft, based in Redmond, Wash., typically issues cautious outlooks. But Tuesday's forecast contrasted with major financial disappointments from two other software makers, PeopleSoft and Siebel Systems. Stung by the reluctance of corporations to buy new technology, the two companies warned on profits in recent days.

Click here for technology stocks

"We continue to operate in a tough environment," John Connors, Microsoft's chief financial officer, told investors during a conference call. Conners said fragile consumer confidence and global economic weakness should affect business through the next fiscal year, which begins in July.

In one down note, Fifth Third Bancorp's Sunil Reddy said Microsoft's unearned revenue, or sales the company expects to get down the road from software upgrades, came in below his expectations. Unearned revenue fell $300 million from the previous quarter, to $8.5 billion.

But Reddy said that the overall quarter was a good one, particularly in Microsoft's server business, a sign that the company is becoming less reliant on the sluggish computer industry.

"That tells you that Microsoft is gaining inroads into the enterprise area," Reddy said. Server platforms revenue grew 21 percent in the quarter.

| Related Stories

|

|

|

|

|

The company, whose Windows operating systems and Office software are heavily dependent on computer sales, has been diversifying.

Microsoft made several acquisitions in the enterprise software area to compete more effectively against Oracle, most notably scooping up business-to-business e-commerce software company Great Plains and accounting software developer Navision.

Its Xbox computer game console competes against Nintendo's GameCube and Sony's PlayStation. And Microsoft's MSN Internet service goes head-to-head with America Online, a unit of AOL Time Warner, which also runs CNN/Money.

Nasdaq poised to jump

Even with Tuesday's after-hours gains, Microsoft shares are down 0.5 percent this year, a decline that has dropped it to the No. 2 company by market value, behind General Electric.

But the Nasdaq composite, a kind of barometer of technology stocks, is up 3.8 percent in 2003, as investors bet that the worst for the sector may have passed.

The Nasdaq's gains are likely to continue Wednesday morning, thanks to Microsoft and Intel (INTC: Research, Estimates), which also reported better-than-expected earnings and sales. Intel stock jumped 5 percent after hours.

Tuesday's report contained none of the bombshells of the second-quarter release. That's when Microsoft said it would deploy some of its $43.4 billion in cash to pay its first-ever dividend. The payment last month came to 8 cents a share and cost the company $857 million.

Still, the cash pile continued to grow to $46 billion in the quarter, according to Scott Boggs, who conducted his last conference call as Microsoft's comptroller Tuesday. He's leaving the company for an unspecified period of time and will return in a different role, Microsoft said.

By region, Microsoft's third-quarter sales in the Americas rose to $2.912 billion from $2.662 billion a year ago. Sales in the Europe, Middle East, and Africa regions rose to $1.557 billion from $1.385 billion as the company got a benefit from the weakening dollar.

But Asia was weak. Revenue there fell to $871 million from $912 million.

|