NEW YORK (CNN/Money) -

Exxon Mobil Corp. reported Thursday that first-quarter profit more than doubled as it beat Wall Street forecasts for the period.

The world's largest oil company earned $4.8 billion, or 71 cents a share, excluding special items, up from $2.1 billion, or 30 cents a share, a year earlier on the same basis. Earnings tracker First Call had a consensus analysts' earnings-per-share forecast of 70 cents.

Including special items, the company earned $7.04 billion, or $1.05 a share.

In a period that saw U.S. gasoline prices reach a record average of $1.722 a gallon on March 18, the day before fighting started in Iraq, Exxon Mobil's revenue rose to $63.8 billion from $43.4 billion a year earlier.

The company reported record earnings from its exploration and drilling income of $3.99 billion, excluding a gain from sales of a German gas transmission unit. That's up from $1.9 billion in income a year earlier. Earnings from its refining and retail sales operations reached $723 million compared to a narrow loss from the unit a year earlier. Chemicals earnings rose 85 percent to $287 million.

| Related Stories

|

|

|

|

|

"The key advantage for this company is that, even in a difficult environment, they make money." said Friedman Billings Ramsey & Co. analyst Jacques Rousseau.

But many investors fear the blockbuster earnings will not last as concerns about major supply disruptions recede and the oil markets brace for potentially higher output from post-war Iraq. Already, crude oil and natural gas prices fell during March and are significantly lower so far in the second quarter, the company said in a statement.

But David Cooley, investment officer at J. & W. Seligman & Co., said the company is balanced so that a factor that hurts one of its businesses will help another.

"Exxon Mobil is internally well hedged and the raw materials for the downstream and chemicals businesses are the upstream crude oil products, so they should be able to maintain that overall level of profitability."

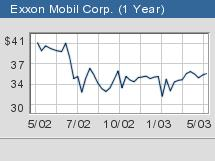

Shares of Exxon Mobil (XOM: Research, Estimates), a component of the Dow Jones industrial average, rose in late-afternoon trading Thursday.

|