NEW YORK (CNN/Money) -

President Bush promises his tax-cut plan will create 1.4 million new jobs but the numbers his economic advisers have produced don't add up.

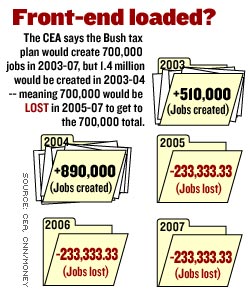

In fact, according to their numbers, the plan creates about 700,000 extra jobs, spread out over the next five years.

Though the president's Council of Economic Advisers says the plan might create even more jobs than that, by encouraging investment and growth, it won't reveal its estimates of how many jobs that extra burst of growth will create.

The Economic Policy Institute, a Washington think tank opposed to the Bush plan, pointed out this week that the CEA says Bush's plan to cut $726 billion in taxes would extend job growth by an average of 140,000 jobs a year from 2003-2007, or a total of 700,000 jobs.

In other words, total employment would have been 143.4 million in 2007 without any tax cuts. With the tax cuts, employment will be 144.1 million.

So far, not so bad. 140,000 jobs a year isn't much of a boost -- most economists think at least 125,000 jobs need to be created every month to keep the unemployment rate from rising -- but it's better than nothing, and terrific for the 140,000 people who get the extra jobs.

But here's the problem: the CEA also said the Bush plan would create a total of about 1.4 million jobs in 2003 and 2004 -- and that's the number Bush and his supporters most often cite when talking about the stimulative effect of his plan.

But in order to get to 700,000 total jobs created in 2003-2007, you'd actually have to cut 700,000 jobs after creating 1.4 million in 2003 and 2004. The rate of job growth will actually be slower, then, in 2005-07, than it would have been otherwise.

The EPI -- which has posted a letter, signed by about 460 economists, opposing the Bush plan -- said the CEA projection undercut President Bush's argument that Congress should pass either his total tax package or the $550 billion plan supported by the House of Representatives in order to create jobs.

"The striking thing is just the falseness of the claim that 1.4 million jobs are created, in light of their own model. There's a basic element of fraud in that claim," said Max Sawicky, the EPI labor economist who wrote the EPI note about the CEA projection.

Sawicky and some other economists doubt Bush's claims that cutting taxes will stimulate job growth even in the short term. They call for measures that could have a more immediate effect, such as giving money to cash-strapped state governments or extending unemployment benefits.

A White House official, however, said the EPI was being disingenuous by leading people to believe jobs would actually be cut in 2005-07. The CEA's projection, this official said, simply shows that the pace of job growth will be much faster in 2003 and 2004 than it would have been without the tax cut.

"It's hard to talk about the difference between job growth and the total level of jobs and keep it straight, but the people pushing this story know better -- they understand the difference -- they're writing it in a way that's meant to be confusing," the official said.

Still, even some supporters of the Bush tax plan said the CEA was to blame for confusing people with the opacity of its projection.

"I admit to being confused when I try to follow the CEA's job numbers," said Scott Grannis, chief economist at Western Asset Management in Pasadena, Calif., one of 115 economists who signed their own letter in support of the tax plan.

"But obviously the CEA is not projecting job losses as a result of the package -- that would make no economic sense -- so I think EPI is misrepresenting the plan or misinterpreting the numbers," Grannis added.

Supporters of the tax plan say reforming the tax code and cutting individual taxes on dividends, along with the other cuts the president has proposed, will encourage investment and risk-taking. As a result, productivity, standards of living and job creation will increase for years to come, in a way that's impossible to gauge.

But they also take the CEA to task for not making an effort to make this case.

"This [forecast] was very poorly conceived; there's no other way around it," said David Gitlitz, chief economist at the research firm Trend MacroLytics, well known for his supply-side approach to forecasting. "The CEA left themselves wide open for the EPI to take these kinds of shots at them."

|