NEW YORK (CNN/Money) -

PeopleSoft Inc. said Thursday it rejected Oracle Corp.'s hostile $5.1 billion cash takeover bid, but industry analysts said that the database software maker may eventually raise its offer.

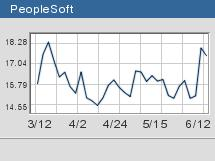

Oracle announced its $16-a-share offer for PeopleSoft last Friday.

In rejecting the bid, PeopleSoft said its board determined the offer was too low, and that an Oracle-PeopleSoft combination probably would raise antitrust concerns in the United States and Europe. It added that a prolonged review of the deal would hurt PeopleSoft's performance by creating uncertainty in the enterprise software market.

When Oracle announced its bid last week, CEO Larry Ellison said Oracle had no intention of selling PeopleSoft products and that it would try and switch PeopleSoft's customers to Oracle's software products.

"Oracle's offer seeks to enrich Oracle at the expense of PeopleSoft's stockholders, customers and employees," PeopleSoft CEO Craig Conway said in a statement. "We believe that Oracle's proposed acquisition of PeopleSoft would stifle competition and limit customer choice."

PeopleSoft said it will proceed with its plan to buy J.D. Edwards, another software company, a bid announced four days before Oracle's offer.

Separately, J.D. Edwards said Thursday that it welcomed PeopleSoft's decision to reject Oracle's bid. "Oracle's hostile action benefits Oracle alone and is designed to disrupt the momentum of both of our companies and the technology marketplace," said J.D. Edwards CEO Bob Dutkowsky in a statement.

To that end, J.D. Edwards announced late Thursday that it was suing Oracle in a state court in Colorado claiming that Oracle is interfering with its proposed merger with PeopleSoft. The company also said it was filing a lawsuit against Oracle in California and is seeking an injunction that would stop Oracle from proceeding with its tender offer for PeopleSoft.

Shares of PeopleSoft (PSFT: Research, Estimates) fell 1.4 percent Thursday to $17.37 but remained nearly 10 percent above Oracle's offer, indicating investors expect a higher bid to emerge. PeopleSoft held a conference call on Thursday to discuss the rejection but refused to answer questions about what it would do if Oracle raised its offer.

J.D. Edwards (JDEC: Research, Estimates) edged up 2 cents to $13.36, while Oracle (ORCL: Research, Estimates) gained about 0.5 percent to $13.33.

Oracle reported better-than-expected fiscal fourth-quarter earnings after the closing bell Thursday. During its conference call, Ellison said that PeopleSoft shareholders would be better off with $16 in cash than PeopleSoft stock following a merger with J.D. Edwards, noting that PeopleSoft's stock traded at less than $16 before Oracle announced its bid.

Still, analysts think Oracle will need to raise the bid at some point. Jason Brueschke, an analyst with Pacific Growth Equities, said Oracle is unlikely to raise its offer anytime soon, however. "Oracle has some time to see how this plays out in the market. I would expect them to go directly to PeopleSoft shareholders before raising the bid," said Brueschke.

One possible roadblock to raising the offer: Credit rating agency Moody's cut its outlook on Oracle's debt to negative Wednesday, citing concerns about the effect a PeopleSoft merger would have on the balance sheet. Standard & Poor's, the other big credit rating agency, issued similar comments last Friday.

Check software stocks

Still, Oracle had more than $6.5 billion in cash on its balance sheet at the end of May, and it secured additional financing from Credit Suisse First Boston if it needs more cash. What's more, PeopleSoft had $1.9 billion in cash on its balance sheet at the end of March.

Kimberly Caughey, an analyst with Parker/Hunter, a retail brokerage house based in Pittsburgh, said regardless of what the credit agencies do, Oracle should be able to offer more cash if it sees fit, rather than issuing stock.

She said that if PeopleSoft shareholders are unwilling to accept a $16 bid, Oracle will ultimately raise the price. But she does not think that Oracle will be in any hurry to increase its offer.

"This is going to go on for a while," Caughey said.

Analysts quoted in this story do not own shares of Oracle and their firms have no investment banking relationship with the company.

|