NEW YORK (CNN/Money) - Even as real estate prices rocket up, some Americans still hope to buy a dream house for pennies on the dollar by purchasing a deeply discounted, foreclosed home. Can these orphan properties really save you big bucks?

Maybe. But don't expect it to be easy. Finding a bargain while skirting the pitfalls involves a lot of hard work and a bit of luck.

Chasing the Dream

Tim McGee, co-founder of Foreclosures.com, calls tenacity the most important requirement for success. The ideal shopper, he says, is "that optimistic soul who's digging through a roomful of horse manure because he's convinced that somewhere in there is a pony."

Michelle, a New York-based ad salesperson, struck gold 10 years ago. "I made a list of all the banks around. At the time they had a lot of apartments they were trying to unload," she said. She got long lists of brokers handling the various banks' foreclosures and looked at lots of places.

She wound up paying just $20,000 for a one-bedroom on Manhattan's Upper West Side. She sold it five years later for $125,000.

But such success stories are much rarer after the recent real estate boom.

If you decide to look for a foreclosed property, there are several points in the foreclosure process, and after, during which you can make your move.

Stage one: default

Your first opportunity comes in the "pre-foreclosure" stage, when owners have already defaulted on their mortgage payments but actual foreclosure hasn't happened yet. To find out about houses in default, visit the local courthouse where defaults are registered. You can then make offers directly to the defaulting homeowner.

However, few pre-foreclosure bargains exist among the most desirable homes, according to Robert Bruss, a syndicated real estate columnist who also runs seminars on real estate investing. Many of those will sell for near their appraised values.

Properties that sell at a 20 percent to 40 percent discount usually need repair or are in unstable communities.

At this stage you have about 90 days to act after the default notice is posted and another 21 to 25 days after auction sale date is published.

Stage two: the auction

If a property doesn't sell in pre-foreclosure it goes to public auction. During this stage you can find the best bargains, but it is fraught with difficulties.

Here's some of what you're up against:

- Many auctions are canceled at the last moment as the property has been sold or payments reworked.

- Court-appointed trustees only accept cash or cashiers' checks.

- There's little time to arrange inspections, so bidders may have no clear idea of what they're buying.

- Properties are sold "as is," without warranties. Sellers needn't disclose problems. Buyers may find themselves with unexpected -- and expensive -- repairs.

Simply put, these auctions are too risky for most buyers, says McGee. A property could have multiple loans, liens, back taxes, be in need of major repairs, "all sorts of ugly stuff," he says. He knows people who have lost in "the high five digits" on foreclosed homes bought at auction.

|

|

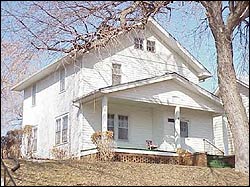

| This 3-bedroom Sioux City, Iowa, home is for sale in eBay's foreclosed properties area. Asking price: $59,900 |

One other thing: After you buy at auction, the former owners may still be living there and you'll have to evict them. And some states have a right of redemption law; former owners can buy back the house for the amount of the winning bid. They may do this for periods ranging from a month to a year, depending on the state. After you pay for the house and other expenses -- even repairs -- the house could be reclaimed by its previous owner.

Stage three: post-foreclosure sale

The outcome of most auctions is that the lender, usually a bank, will buy back the property by bidding the amount of the mortgage. It later resells the property through a broker.

Bruss says this is the best chance for "mom and pop" to buy a foreclosure. "I've bought from high bidders who just wanted to provide the financing," he says. He suggests when a lender buys a house you want, quickly send an overnight letter to the bank president offering to pay their bid price for the property. The bank may want a quick turnover.

Banks do want to maximize profits, though. So buying from a lender these days may not result in big savings, according to McGee. That's a change from the mid-1990s, he says, when banks were having liquidity problems and interest rates were higher, he says. Today, banks can afford to hold out for their price.

At this stage, don't expect much more than a 5 percent or 10 percent discount from market value.

Some of the best foreclosure deals may be had through governmental or quasi-governmental agencies such as Fannie Mae, Freddie Mac, HUD, and the VA. Listings are numerous and available on their Web sites, but the properties they feature are often less upscale. Web auctioneer eBay lists thousands of foreclosed homes, too.

|