PALO ALTO, Calif. (CNN/Money) -

Instinctively, deep in your gut, you knew that a whole bunch of stocks had risen too far too fast this year. Heck, you probably thought the whole market had jumped too much.

Sun Microsystems, we now know, was one of those stocks. Is the rest of the market next?

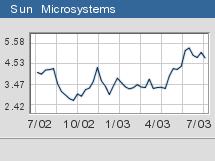

After Wednesday's shellacking of Sun's shares -- a massive 239 million shares changed hands, sending the stock price down 19 percent -- it's obvious that Sun stock price had gotten ahead of itself. It's worth slowing down and reviewing by how much and why.

Before Tuesday night's disappointing earnings report, Sun's shares were up 53 percent for the year. There was no apparent reason, other than ill-considered rumors that Sun was an acquisition target.

Sun's revenues are in decline, its profitability is anemic and as Paul La Monica explains in his recent commentary, the company faces competitive threats from open-source Linux servers on the one hand and Windows-based servers on the other.

Sun gets lots of attention for a few reasons. In the mid-1990s its powerful servers swiped the mid-range computing market away from Silicon Graphics -- more on them in a bit. Then it memorably anointed itself the "dot in dot-com," using marketing muscle to match the mouth of Sun's highly visible co-founder and CEO, Scott McNealy.

Quick with a nasty comment about arch-foe Microsoft, McNealy became one of what Fortune's David Kirkpatrick dubbed the "brash brothers,", pairing McNealy with that other sharp-elbowed fighter in Silicon Valley, Larry Ellison.

The difference between Oracle and Sun is that Oracle continues to dominate databases, an unexciting but highly profitable business.

McNealy typically has two comebacks to explain how Sun will get itself out of this jam. First is that he's done it before, which he has, in the early 1990s when the company was at another strategic crossroads. Second is Sun's cash, $5.7 billion at last count, a powerful cushion for years to come.

Promises of pulling rabbits out of hats, of course, only wow the crowd if the magic continues. And the cash ensures only one thing: that Sun will be around for quite a while. It does not ensure success.

In mid-1998, about three years after its stock started sliding, Silicon Graphics had more than $700 million of cash on its balance sheet, equal to about a quarter of its annual sales.

Sun's stash today is even healthier, about half its annual sales, but the comparison with SGI shows that a cash cushion isn't always enough. (SGI is a nonentity today, still hanging on -- in no small part because of its cash -- but just a shell of its former self.)

After its fall Wednesday, Sun's stock is up 24 percent for the year, compared with a 29 percent gain for the Nasdaq. Is either justified?

The name game

Shareholders of Millennium Pharmaceuticals (MLNM: Research, Estimates), probably breathed a sigh of relief Monday when they realized it was other Millennium, Millennium Chemicals (MCH: Research, Estimates), that was reporting bad news.

| Recently by Adam Lashinsky

|

|

|

|

|

The Red Bank, N.J.-based chemicals company cut its dividend, reduced its outlook and announced the departure of its CEO. The stock fell 20 percent.

Then, as if it felt left out, the similarly named Cambridge, Mass., biotech concern (Millennium Pharmaceuticals) cut its outlook the very next day, sending its shares down 5 percent.

Clearly, it's not a good Millennium so far.

Adam Lashinsky is a senior writer for Fortune magazine. Send e-mail to Adam at lashinskysbottomline@yahoo.com.

Sign up to receive The Bottom Line by e-mail.

|