NEW YORK (CNN/Money) -

Never mind the rest of the economy, technology is already in the midst of one heck of a recovery.

After getting hammered in the downturn, tech has come back big time. Output for the tech sector was up 9.3 percent in June versus last year, according to the Fed, and the Commerce Department reports that tech companies are taking in new orders faster than they're shipping out the old ones. In the second quarter, business spending on tech equipment was up 10.8 percent from 2002 levels.

Remember all that talk about how U.S. companies had more tech than they knew what to do with, that they wouldn't be spending on tech for years to come? It was wrong. Instead, companies appear to have come to the conclusion that one of the best things they can do with their money is spend it on technology.

Rage against the machine

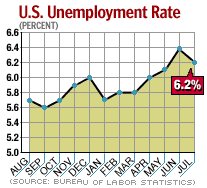

But this is not necessarily a good thing. The reason: Increasingly, it appears that Corporate America is reaping such big productivity gains out of technology that it may decide to hold off on hiring workers. Why give Smithers his old job back when you can buy a few new servers and a dozen new desktops for less than you'd have to pay him in wages? And remember, that shiny new Dell Dimension doesn't take vacation and doesn't have any benefits costs associated with it.

"Technology is helping productivity," said Merrill Lynch chief North American economist David Rosenberg. "But right now it's coming at the expense of employment."

The decision to spend money on new tech equipment rather than on employing new workers is getting easier. First, the cost of computer goods and services continues to fall while employment costs continue to rise.

"In that environment, it's only natural to expect the switch from labor into technology," said Carlos Asilis, a portfolio manager with the hedge fund Vega Asset Management.

Player piano

Second, companies have begun to better understand how to use technology. The result has been a big jump in productivity. In the second-quarter it grew at an annualized rate of 5.7 percent. What's that mean? Simply put, that the cost of producing goods has been sharply reduced.

"Companies have been able to maintain incredible productivity growth for a low-growth economy," said Lehman Brothers chief U.S. economist Ethan Harris. "It does look like firms are finding ways to use technology and make do with fewer workers."

This productivity growth is good news for profits, but not good news for the unemployed, or underemployed, if the money doesn't start shifting their way. Technology is also hurting U.S. workers in another way, Asilis suspects -- by enabling companies to more easily move services jobs overseas.

None of this is particularly good for consumer spending, which already looks set to slow thanks to a fall off in mortgage activity. It may be that technology, at least for the moment, is more hindrance than help for the economy.

|