NEW YORK (CNN/Money) -

Investors have been naming a lower price for Priceline.com's stock lately.

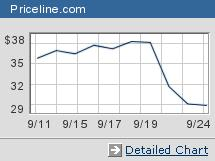

The shares of the discount online travel company known for its auction-like approach to selling airline tickets, as well as some bizarre commercials featuring William Shatner, have tumbled about 22 percent this week.

It appears the main reason for the selloff is an acquisition of Priceline (PCLN: down $0.04 to $29.45, Research, Estimates) rival Hotwire by Barry Diller's online commerce company InterActive (IACI: down $0.31 to $36.18, Research, Estimates). Ethan McAfee, an analyst with Capital Crossover Partners, a hedge fund firm, said that investors were disappointed that the acquisitive InterActive did not buy Priceline instead.

| |

|

Shares of Priceline.com took a huge hit after InterActive bought Hotwire earlier this week.

|

|

Speculation that Priceline could be a takeover target helped contribute to a runup in the stock this year. Before the Hotwire deal was announced Monday, Priceline's shares had nearly quadrupled in 2003.

"Priceline's stock rallied because it was the only major public Internet travel pure play left. That's half the reason why people owned it," said McAfee, whose firm has no position in Priceline or InterActive.

Michael Mahoney, managing partner with hedge fund EGM Capital, said investors are also worried about how Priceline will fare against a much larger rival. InterActive also owns online travel companies Expedia and Hotels.com.

"Hotwire was already growing really fast and was a strong competitor. Put InterActive's resources behind it and that puts Priceline at a disadvantage," said Mahoney. EGM owns shares of InterActive.

| Related stories

|

|

|

|

|

In addition, the Hotwire deal also caused Wall Street to question just how much Priceline should really be worth, McAfee said. InterActive agreed to pay $685 million, including the assumption of $20 million in options and warrants, for closely held Hotwire.

InterActive said Hotwire should have about $700 million in gross bookings this year, which is the full price of a ticket sold to a customer. Companies like Hotwire, Priceline and other travel agencies typically keep a small amount of the gross booking as actual revenue.

Based on these figures, InterActive is paying slightly less than 1 times estimated gross bookings for Hotwire. Priceline, on the other hand, had a market value of $1.4 billion before the Hotwire deal was announced, and analysts were estimating that the company would generate about $900 million in gross bookings in 2003, according to First Call.

So Priceline was trading at 1.5 times gross bookings before the Hotwire acquisition. And even with the stock's drop of the past few days, Priceline's market value is still $1.1 billion, or about 1.2 times gross bookings estimates.

It could be argued that a more reasonable market value would be about $900 million, or one times gross bookings estimates for this year. That implies a stock price of about $23.67, which is 20 percent below its current price. A retreat to that level is possible, given that the company is less likely to be taken over.

"A lot of people made a fair amount of money in the stock, so with a negative news event it makes sense to take some profits off the table," Mahoney said.

|