NEW YORK (CNN/Money) -

U.S. stocks closed lower on the day Friday and on the week, with investors taking profits in technology and other sectors on concerns about everything from earnings to energy prices.

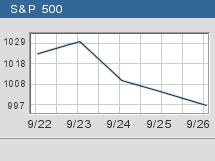

On the day, the Nasdaq composite (down 25.17 to 1792.07, Charts) lost 1.4 percent, the Dow Jones industrial average (down 30.88 to 9313.08, Charts) lost 0.3 percent, and the Standard & Poor's 500 (down 6.42 to 996.85, Charts) index lost 0.6 percent.

For the week, the Dow is down 3.4 percent, the S&P 500 is down 3.8 percent, and the Nasdaq composite is down 5.9 percent.

It wasn't an easy week on Wall Street. Currency concerns brought out the bears Monday, while OPEC's choice to cut oil production in the fourth quarter brought the sellers back Wednesday. Profit-taking Thursday stemmed from Kodak's significant dividend cut. Friday it was about mixed economic news and some portfolio manager end-of-the-quarter reshuffling.

"I think everybody's kind of worn out from the volatility this week, with stocks losing steam on the dollar worries earlier in the week and OPEC's decision to cut oil output," said Robert Philips, president and chief investment officer at Walnut Asset Management. "The statistics du jour are leaving people confused, whether it was the drop in jobless claims yesterday or today's rise in GDP growth. You may see a little more selling in the next few weeks, but seasonally, that wouldn't be unusual."

The major indexes also erased all of their gains for the month. However, with September being notorious for stock selling, the market's ability to close flat or even modestly lower was not such a bad performance, analysts said.

After months of rallying, stocks are still in positive territory year-to-date. The Dow is up 11.7 percent, the S&P is up 13.3 percent, and the Nasdaq is up 34.2 percent as of Friday's close. Some investors have sought to make some money off those gains, and may also be nervous that the rally has been too quick and could falter.

With a large slew of economic news next week and precious few earnings, investors will likely be focused on whether the data confirms or contests expectations for a recovery, Philips said.

Reports on August personal spending and income are due Monday before the opening bell, and both are expected to hold fairly steady from the previous month. However, Tuesday's economic news will probably be more market-moving.

Consumer confidence for September is due after the start of trade Tuesday. Its forecast to show a rise to 82 from 81.3 last month, according to Reuters estimates, and will be particularly scrutinized in light of Friday's weaker consumer sentiment reading from the University of Michigan. Also due Tuesday: the Chicago Purchasing Managers Index (PMI), a regional manufacturing survey. It's expected to show a drop to 55.5 in September, down from 58.9 in August, but still above 50, a level that signals expansion in the sector.

Friday's movers

Among the movers, Dow stock 3M (MMM: up $1.84 to $143.45, Research, Estimates) gained 1.3 percent after Banc of America Securities upgraded it to "buy" from "neutral," while Eastman Kodak (EK: down $0.75 to $21.40, Research, Estimates) continued to slide, losing around 3.4 percent, after Goldman Sachs and Smith Barney cut their 2004 earnings outlook for the company after its announcement of a shift in business focus Thursday. Kodak plunged nearly 18 percent Thursday after it cut its dividend by more than 70 percent, and said it would move away from traditional film and into the ink-jet printer market.

|

|

|

Shares of Motorola (MOT: unchanged at $12.53, Research, Estimates) fell almost 5 percent in active NYSE trade after a Wall Street Journal article said that due to delays in production of the company's camera phones, the product won't reach the market before the important December holiday season. However, the company's shares recovered in the after-hours, after the company released a statement near the close saying that it was "well-positioned" for the season.

Shares of Research In Motion (RIMM: up $1.57 to $37.29, Research, Estimates) gained 4.4 percent after the company reported earnings of 10 cents a share, up from a year earlier and better than analysts were expecting.

A set of economic reports attracted investors' attention Friday. The final reading on second-quarter gross domestic product growth was revised upward to 3.3 percent from an earlier reading of 3.1 percent. Economists surveyed by Reuters had expected it to hold steady.

But this positive news was tempered by the final reading on consumer sentiment in September from the University of Michigan, released about 15 minutes after the start of trading. The U of M's sentiment index was revised downward to 87.7 from a previous reading of 88.2. Economists surveyed by Reuters had expected it to be revised upward to 88.5.

Market breadth was decisively negative, with losers beating gainers by five to three on the Nasdaq, where 1.82 billion shares traded, while on the NYSE the decline/advance ratio stood at three to one, with 1.42 billion shares changing hands.

Treasury prices were higher, with the 10-year note yield down to 3.99 percent from 4.08 percent from late Thursday. The dollar fell against the yen and the euro.

NYMEX light sweet crude oil futures fell 13 cents to settle at $28.16 a barrel. COMEX gold tumbled $4.10 to settle at $381.80.

|