NEW YORK (CNN/Money) -

Treasury prices fell sharply Friday after jobs data, released during the morning, showed the first employment gains in eight months, catching the bond market off guard.

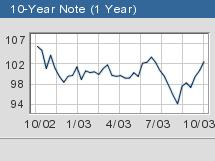

Right before 4:00 p.m. ET, the benchmark 10-year note was down 1-21/32 in price to 100-12/32, hoisting the yield to 4.20 percent from 3.99 percent late Thursday. The 30-year Treasury bond fell 2-15/32 in price to 104-1/32, pushing its yield up to 5.10 from 4.94 percent late Thursday.

The two-year note lost 5/16 of a point in price to 99-31/32, yielding 1.64 percent, while the five-year note shed 1-1/32 to 100-1/8, yielding 3.10 percent.

By contrast, the employment report helped the dollar. In late-afternoon trading, the dollar advanced against the yen, trading at ¥110.90, up from ¥110.44 late Thursday. The euro bought $1.1570, down from $1.1698 Thursday.

Despite lingering signs of labor market weakness, the 57,000 jobs added to U.S. payrolls in September hinted at a possible turnaround in the long-slumping labor market. Analysts had been looking for a drop of 30,000 jobs.

"We are getting moderate employment growth, certainly not of the size of a typical economic recovery, but we are getting job growth," said John Silvia, chief economist at Wachovia Securities in Charlotte, North Carolina.

Bond prices fell as the market priced out any chance of another cut in U.S. interest rates and once again began to wonder when the Federal Reserve might start to tighten policy.

The Fed has made it clear that a lack of jobs growth was its greatest worry, so if the figures truly do portend a recovery in employment it will likely hasten a point when interest rates will be raised.

"The market had been upping the odds of a cut in recent days and this report has forced them to pull back from that," said Jim O'Sullivan, an economist at UBS.

"The data are encouraging, but obviously it's too early to say this is the start of an improving trend. The Fed is very much on hold," O'Sullivan added.

The unemployment rate stayed at 6.1 percent, confounding expectations of a rise to 6.2 percent.

Traders noted the Labor Department estimated that its annual benchmark revision would result in a downward move of 145,000 in the level of employment. That was a complete reverse of market speculation which had called for an upward revision of between 400,000 and 600,000.

-- Reuters contributed to the story.

|