NEW YORK (CNN/Money) -

Treasury prices rose for a third session Tuesday, steadying after Monday's comments from Treasury Secretary John Snow, while the dollar retreated against major currencies.

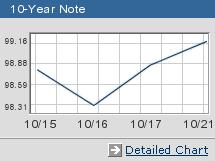

Just before 5:15 p.m. ET, the benchmark 10-year note rose 10/32 of a point to 99-8/32, yielding 4.35 percent, down from 4.39 percent late Monday. The 30-year bond gained 16/32 of a point to 102-14/32, with a yield of 5.21 percent, down from 5.23 percent late Monday.

The five-year note tacked on 5/32 of a point to 99-8/32 with a yield of 3.29 percent, while two-year notes rose 1/32 of a point higher to 99-19/32 with a yield of 1.84 percent. Bond yields and prices move in opposite directions.

In the currency market, the dollar fell versus both the yen and the euro. The European currency bought $1.1669, up from $1.1639 late Monday. The dollar bought ¥109.50, down from ¥110.27 late Monday.

A lack of major economic reports Tuesday left investors to continue to consider the previous day's comments and counter-comments about interest rates and the dollar.

Snow's remarks to British newspaper the Times Monday were taken as a sign that Washington wanted higher interest rates and was not looking to weaken the dollar.

The Times quoted Snow as saying: "Higher interest rates are an indicator of a strengthening economy. I'd be frustrated and concerned if there were not some upward movement in rates." The comments sparked a wave of hedge fund selling early Monday.

A Treasury spokesman said later that Snow was talking about market rates and not saying what the Federal Reserve should do with its benchmark short-term lending rate, lifting bonds off their lows of the day.

"I don't think foreign investors buy these comments from Snow, and that the U.S. believes in a strong dollar. It is a bit old and one of the reasons why you have not seen the flows into the U.S. to support the dollar," Paresh Upadhyaya, a currency analyst at Putnam Investment Management in Boston, told Reuters.

Bond investors reacted positively to Federal Reserve Bank of Richmond President Alfred Broaddus' observation late Monday that the economic recovery still faced significant weaknesses. Broaddus also said the sluggish job market posed the main risk to consumer spending.

"He thinks the [Fed] is right to remain focused on the risk of falling inflation," noted Christopher Low, chief economist at FTN Financial.

-- Reuters contributed to this story.

|