NEW YORK (CNN/Money) -

Forget the Internet.

Sure, stocks like Amazon.com (AMZN: Research, Estimates) and Yahoo! (YHOO: Research, Estimates) are all the rage this year on Wall Street. But venture capitalists, the investors who are looking for private companies that could become the next Amazons and Yahoos, appear to be over their online obsession.

According to the most recent MoneyTree Survey, a report put together by PricewaterhouseCoopers, Thomson Venture Economics and the National Venture Capital Association, which tracks venture capital investments, biotech and medical equipment firms are really the next big thing.

Although overall VC funding in the third quarter dipped 8 percent from the second quarter, investments in so-called life science firms increased 14 percent.

|

|  | Sector† |  | VC funding YTD† |  | Biotech & medical equipment† | $3.2 billion† |  | Software† | $2.5 billion† |  | Telecommunications† | $1.6 billion† |  | Networking equipment† | $1.2 billion† |  | Semiconductors† | $730.2 million† |  | Media & entertainment† | $579.1 million† |

|  |  |

| †Source:††MoneyTree Survey |

|

What's more, biotechs and medical equipment firms received about $1.2 billion in funding, or 30 percent of the total investments in the third quarter, the highest percentage in six years.

By way of comparison, investments in three of the hottest areas from the bubble days of the late 1990s and 2000 -- media and entertainment, networking equipment and telecommunications -- received just a little more than $1 billion in funding combined.

The sound of a bubble inflating

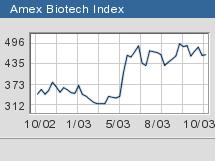

So is there a biotech bubble in the making? Maybe. Biotech stocks have surged substantially and are outpacing the broader market: the Amex Biotech Index is up 37 percent this year and 53 percent since the market's overall lows last October, while the S&P 500 is up 18 percent this year and 33 percent from a year ago's nadir.

With that in mind, the IPO pipeline is now chock full of high-tech health-care companies. Four biotech firms are on tap to go public this week. And seven of the 27 companies that have filed for initial public offerings since the beginning of September are either biotechs or medical equipment firms.

During a conference call Monday to discuss the third-quarter VC funding results, there was a lot of spin about how biotech is not really another bubble.

Tracy Lefteroff, global managing partner of private equity and venture capital for PricewaterhouseCoopers, said that biotechs are benefiting from true growth drivers, i.e., an aging population that will need new medications and treatments. That may be true.

And Jesse Reyes, vice president of Thomson Venture Economics, said that due to massive start-up costs for biotechs, it's unreasonable to expect as many new biotech firms as there were Internet companies in the late 1990s. This also may be true.

But biotech is notorious for speculative stock crazes. Remember the late 1980s and early 1990s? Amgen (AMGN: Research, Estimates), for example, surged in 1990 and 1991. But it took the stock until the summer of 1995 to return to its late 1991 levels after the biotech bubble burst.

| Recently in Tech Biz

|

|

|

|

|

More recently, many biotechs skyrocketed in 1999 and early 2000 during the genomics craze. And stocks like Celera (CRA: Research, Estimates) and Human Genome Sciences (HGSI: Research, Estimates) are still trading more than 90 percent below those bubble-induced peaks.

What makes investing in biotech more difficult than, say, an Internet stock, is that it is much more difficult to understand the science behind their products and predict whether drugs will be approved. Biotech stocks are incredibly volatile, subject to huge one-day swings when companies announce clinical trial results or regulatory news.

Still, now that some biotechs are set to test the public markets, you have to think that this will lead to even more funding in this area, which should further fuel the average investor's appetite for biotech.

"The IPO market is a big driver for us," concedes Gregg Adkin, general partner of Valley Ventures, a Phoenix-based VC firm that has about a third of its funds in life sciences companies. "You do tend to see a lot of VCs flocking to hot areas, which is no different from investors in the public markets."

So are venture capitalists to blame for funding too many speculative companies with little chance of succeeding? Or is Wall Street guilty for continuing to bid up shares of public biotechs and justifying venture capitalists' investments? To be honest, I think that's a "chicken or the egg" type brain-twister that is really irrelevant since both are probably at fault.

What does matter is that biotechs, public and private, are once again starting to be showered with money. And because of this, the average investor needs to be more cautious.

Sign up to receive the Tech Biz column by e-mail.

Plus, see more tech commentary and get the latest tech news.

|